WinTax

If you have any queries, or if you need any help downloading and installing, call Nick now on 011 794 8361 or 082 453 7632. Nick will gladly help you and talk you through everything (ask Nick for a discount).

WinTax allows you to process, save & retrieve an UNLIMITED number of tax calculations and assessments in the database! Check all SARS’s calculations! Turn your pc into a tax expert! Get bigger tax refunds for your tax clients!

WinTax has been chosen for use by Old Mutual, under license agreement, every year since 1999.

What will WinTax do for you? Will WinTax make you more professional? Watch this 7-minute video to see a brief description of WinTax features and screens showing what WinTax will do for you and how WinTax will help you in your business! WinTax will turn your computer into a tax expert with all the tools you need to save you time and money. WinTax is the most trusted, most accurate and most comprehensive tax software available. WinTax2020 and 2021 screens used in this video.

You can expand the size of the video for a higher-definition picture. You will need sound for the video. If your pc does not have speakers then plug your cell-phone’s “ear-bud” ear-phones into the green jack on your computer.

Although WinTax is written to work under Microsoft Windows operating systems, if you install WinTax on a Cloud then WinTax can be accessed, and used, on any device from Windows PC’s, AppleMac, Android and IOS phones and tablets etc.

Scroll further down this page to see pictures of the WinTax screens.

Features and options offered by WinTax

- All the new Retirement Fund laws explained with the new deductions claims worked out for you.

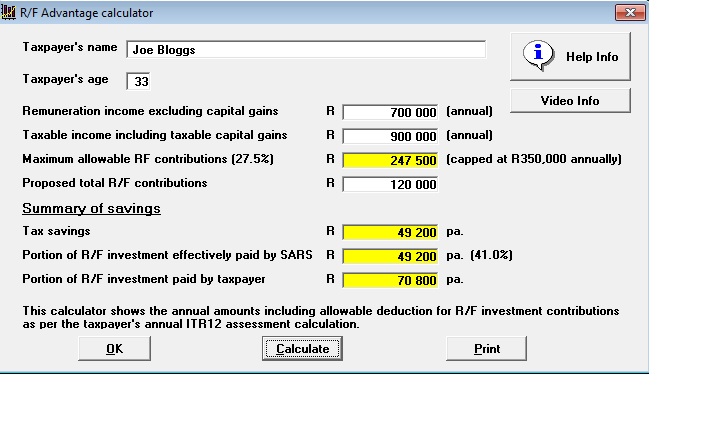

- New Retirement Fund Advantage Calculator.

- Unlimited number of IRP5 and IT3 tax certificates may be entered.

- Screens bristle with “info” buttons. Click on them to open a window displaying handy info and tax tips.

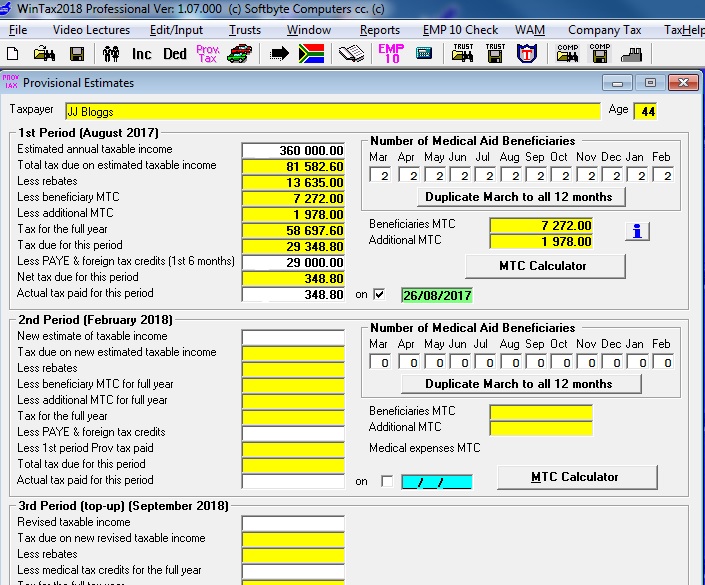

- Assessment and provisional estimate calculators for personal taxpayers.

- Also caters for deceased personal taxpayer’s assessment taxes for the last year of life with changes to CGT exclusions and primary rebates etc.

- Assessments and calculators for Trusts.

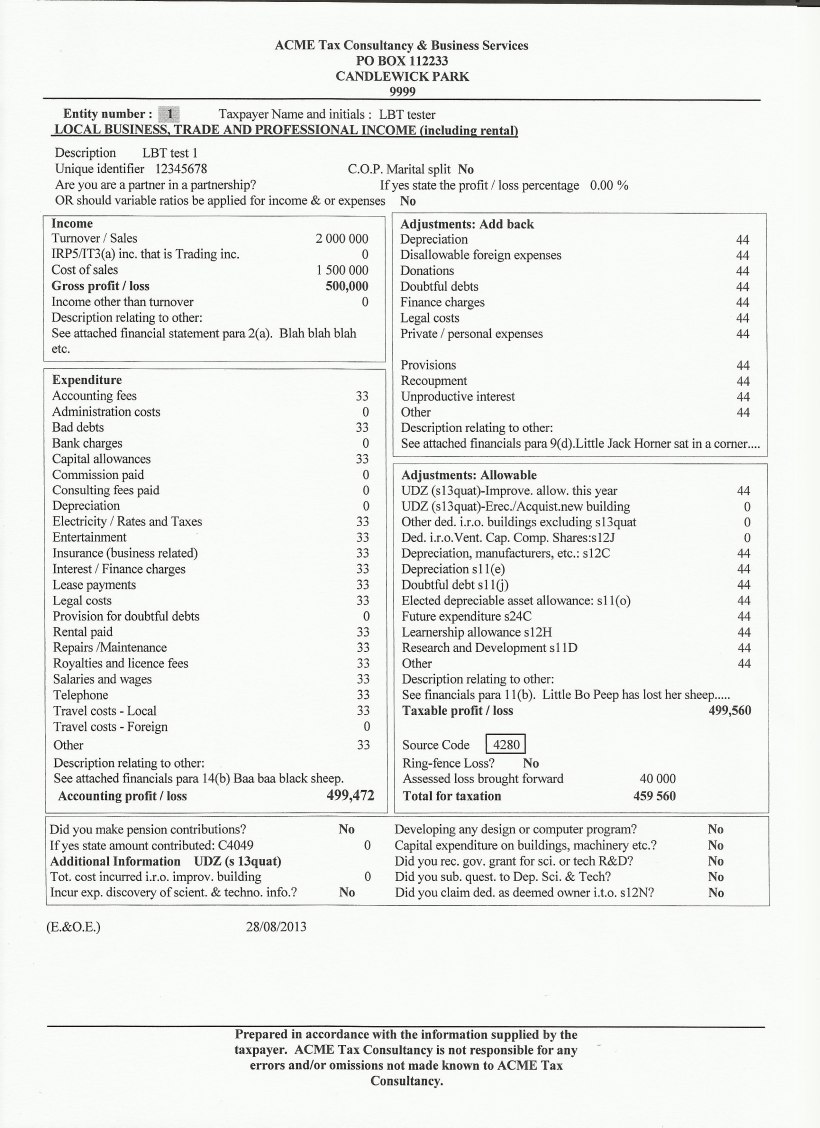

- A variety of different reports, summaries, full assessment reports, ITR12 Reports etc can be viewed, printed in English or Afrikaans or optionally exported to word processors or spreadsheets for additional editing before printing or emailing.

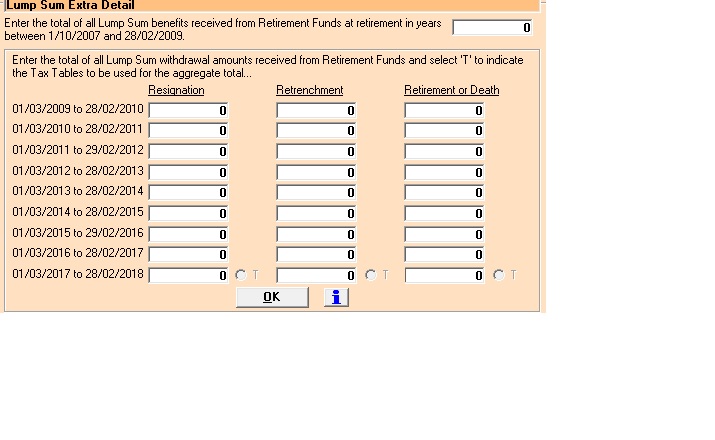

- Taxation of lump sums is catered for completely – especially with new legislation regarding the taxing, at tiered rates, of the accumulative method of taxing lump sums received from retirement funds since 1st October 2007. Severance packages, ex-gratia lump sums, retrenchment packages, pre-retirement withdrawals and normal retirement packages all catered for. SARS’s accumulative method of taxing lump sums fully catered for; enter multiple lump sums in one year or over multiple years.

- New Retirement Savings Plan investment product (tax-free interest) introduced in 2016 tax year catered for – including taxes levied on over-subscriptions.

- Tax review calculators and provisional estimate calculators for different types of companies, cc’s etc.

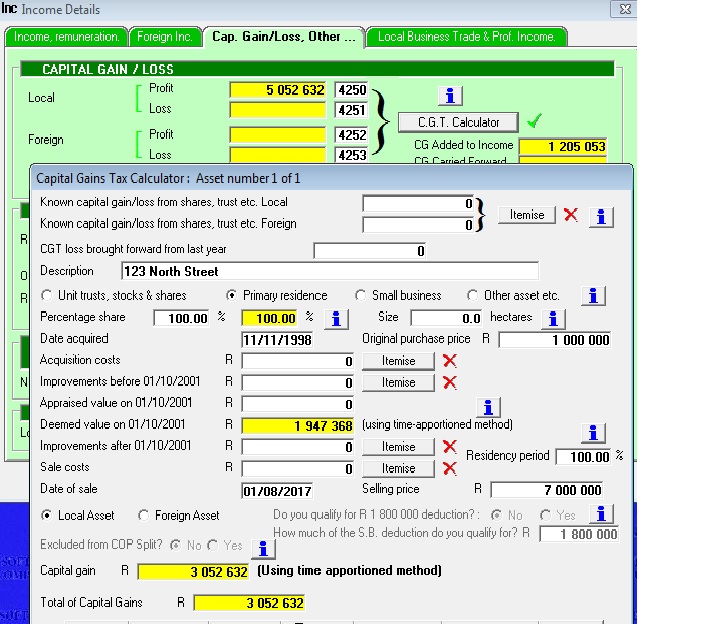

- Full CGT calculator allows you to choose between valuation or base cost method, Time Apportioned Base cost deemed value and 80%/20% method to show differences. Unlimited number of CGT transactions may be entered. WinTax works out all values for you. Caters for disposals of shares, primary residences, 2nd properties, other assets, part-ownership, small business disposal, CoP, residency periods, loss limitation clauses etc. WinTax uses the exclusion amounts and inclusion factors for the applicable tax years.

- Auto Summary window may be moved and located anywhere on the screen. Auto Summary shows all the “bottom-line” amounts updated immediately you change anything on the Income screen, Deductions screens etc.

- New Personal Taxpayer dividends tax for local and foreign dividends earned. Forefeited amounts on foreign taxes deducted offshore where applicable, s6quat limits etc

- CGT Calculator may also be used as a register for storing assets which may attract CGT in the future. WinTax will carry the purchase and other details of these assets forward year after year until a disposal triggers a CGT event.

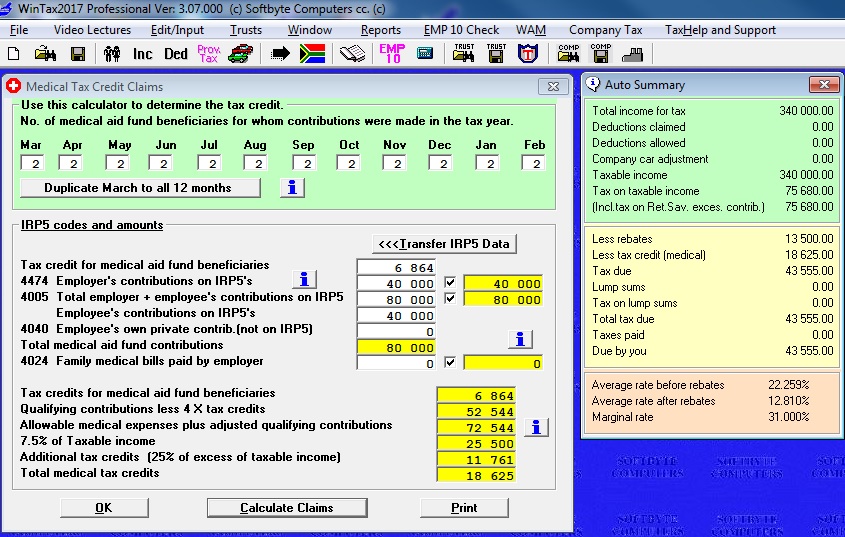

- Whether it be the old capped amounts or the new tax-credit system, WinTax’s medical claim calculators are known throughout the tax industry as being 100% accurate and correct – no matter how complex the scenario.

- WinTax includes the new conversion of contributions and medical expenses to tax credits.

- Travel Allowance claim caters for single or multiple cars per year per taxpayer (up to 9 cars per taxpayer in a year). Caters for any scenario of records kept or not kept, allowance received or no allowance received. All the latest cent/km costs are built in!

- Check the dramatic effects of compounded Unit Trust investments with huge tax advantages.

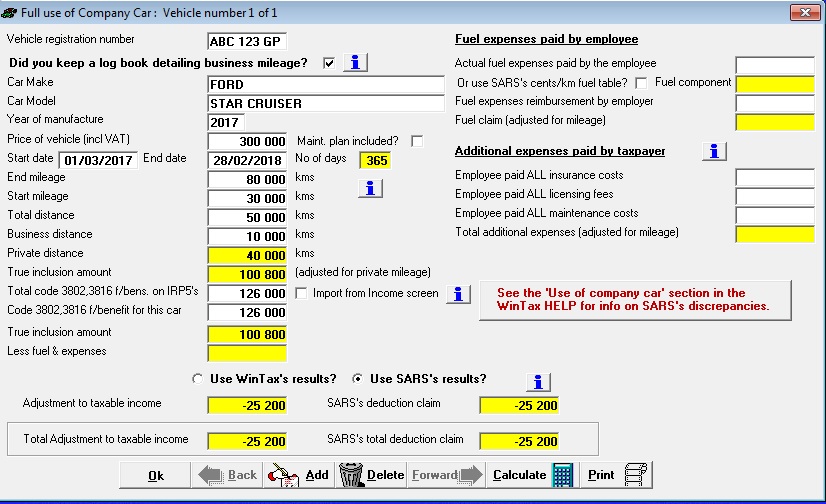

- Check claims against “use of company car” fringe benefit amount (unlimited number of cars may be entered. “Operating lease” scenarios included). See where SARS’s formula goes wrong!

- Check PAYE amounts & medical tax credits IRP5’s, tax amounts on monthly, daily, weekly, fortnightly Pay Slips, UIF, SDL, bonuses, partial periods etc. Also check PAYE & SITE splits on IRP5’s for previous tax years where SITE applies.

- Download free updates from our web site if SARS changes legislation, or if we add extra features during the tax year.

- Free software support. Lines open between 8am and 7pm 7-days a week.

- Save an unlimited number of assessments for Personal taxpayers, trusts and companies in the database.

- Import client data from last year’s WinTax program (no need to retype all that data – just click on a button!)

With so many new changes to tax laws, how confident will you feel without a copy of WinTax on your pc?

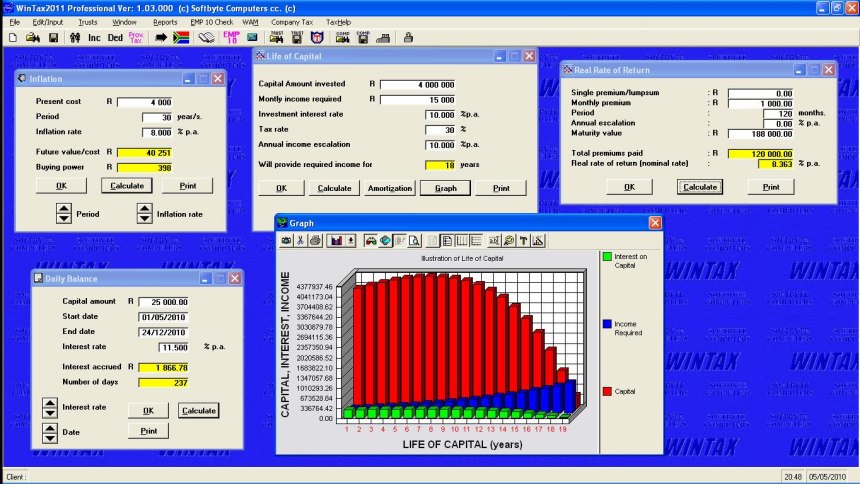

Financial calculators that are included on the WinTax menu

- Compare after-tax monthly income between annuities and fixed deposit investments.

- Compare income between investing offshore and locally – with tax and Rand slide factored in etc.

- How long will invested capital last while drawing income with tax & inflation considered.

- Three different program options relating to loans.

- Inflation projections/future cost projections/depreciation.

- Daily balance and nominal to effective calculators.

- Real rate of return on investments.

- Note that many of these calculators come with amortisations and full-colour 3D graphs.

The Medical Aid Contribution claim calculator in WinTax is invaluable and easily handles the most complex medical aid contribution split scenarios, medical tax credits etc. The calculator processes amounts on the IRP5 and automatically calculates your medical claims and enters your medical claims on the Deduction screen for you. You simply enter amounts from the IRP5 such as codes 3810, 4474, 4005 etc and WinTax shows your claims and medical aid contribution tax credits in an instant. This screen allows you to calculate medical deduction claims for the most complex medical aid contribution claim scenarios. While producers of other tax software programs seem unable to get many of these complicated medical claim calculations correct and even SARS’s seems to be struggling with their own medical claim calculations, WinTax gets them 100% right every time (including the 7.5% taxable income rule). Play around with this screen in WinTax for a few minutes and you will have a better understanding of how the Medical Aid Contribution laws work. Allowable claims for contributions and medical expenses automatically converted to tax credits in WinTax.

Capped amounts, for medical aid fund contributions, have been abolished since 1st March 2012 and replaced by tax credits. At first glance the new tax credit system appears simpler than the old capped amount system but, if you look deeper, the new “non-refundable” tax credit system is even more complex but WinTax handles all calculations with ease – including the most complex contribution splits between employer and employee! Not only does WinTax show you how and where, in the calclation, these tax credits affect the assessment, WinTax also shows you how, and where, these calculations affect daily, weekly and monthly salary-source calculations as well as on annual IRP5’s.

WinTax caters for the latest laws regarding the taxation of lump sums taken from Retirement Funds, including those taken at resignation, severance packages, retrenchment withdrawals, retirement, multiple lump sums in multiple years or a single year etc. The new “accumulative” method of taxing these lump sums is more than complex but WinTax handles it all with the greatest of ease.

WinTax Pro also caters for the admin and taxation of Trusts where you can store all Trust info like Capital Gain assets and sales, trustee’s and beneficiary’s details, details of distributed income (who got what and how much), income and expenditure statements which cross-check to see that you have not paid out more (interest, exempt, taxable, Capital Gain income etc) to the beneficiaries than the Trust earned. All tax calculations including Provisionals etc, done for you. Direct your printouts to the printer or to a word processor where 90% of the financial statement is laid out for you.

WinTax Reports

WinTax offers a variety of different reports including Single-A4 page Assessment Summary Report, Four-A4 page Full Assessment Report, Provisional Estimate reports, reports of itemised amounts, CGT reports, Lump Sum reports, Travel Claim reports, Company Car Claim reports. Any, or all reports may be printed directly to the printer or exported to a word processor for editing (change fonts, colours, add or delete anything) before printing or emailing. Annual Trend reports show the history of the last 5 years assessments for a taxpayer comparing and displaying the percentage change of all pertinent amounts.

A new “Draw Down Annuity Calculator” module added to WinTax especially for financial advisers.

Note that you will need sound to view the video. If your computer does not have speakers then plug your cell-phones “ear-bud” speakers into the green jack on your pc.

Simple Estate Duty Estimator

A quick calculator in WinTax2018 to estimate estate duty and executor’s fees for a client by entering no more than 7 or 8 amounts. On-screen HELP tells what to enter and where. Ever wanted a simple calculator that you can use to enter half a dozen figures to calculate and show an estimate of Estate Duty and Executor’s fees without using a complex 20-page spreadsheet-program? Using such a complex 20-page program often involves spending ages trying to get all the relevant information out of the client just to get an estimate of duty and fees. These financial planners want a quick 10-minute tool to be able to show a client whether they would be facing death-duty fees of R1,000 or R1,000,000 and how some simple estate planning could save high net-worth clients paying the state and executors a fortune. The new Estate Duty Estimator in WinTax is just what many tax planners and financial planners have been looking for and they will agree that this update adds extra value to WinTax. Of course any figures in the Estate Duty Estimator can be saved in the WinTax database, under the client’s name, retrieved, edited and printed (with a disclaimer that the client can sign to protect you).

CGT Calculator

WinTax remains the only tax software in South Africa with a comprehensive Capital Gains Tax register and calculator for both local and foreign capital gain transactions. Other tax programs costing twice as much as WinTax do not even have a CGT register and calculator. WinTax CGT calculator will show you which of the three methods allowed by SARS would give you the lowest Capital Gain amount for tax. Make a mistake by choosing the wrong option with a CGT calculation and it could cost you plenty. This calculator in WinTax exposes SARS’s costly errors with CGT calculations on assessments. This option in WinTax, alone, could save you many tens of thousands of rands in unnecessary tax.

Note that WinTax now includes all the WinTax Admin Manager features. A multitude of search options on offer such as Search for assessments outstanding and the report shows why they are still outstanding; WinTax Admin Manager will show you what information you are still waiting for etc.

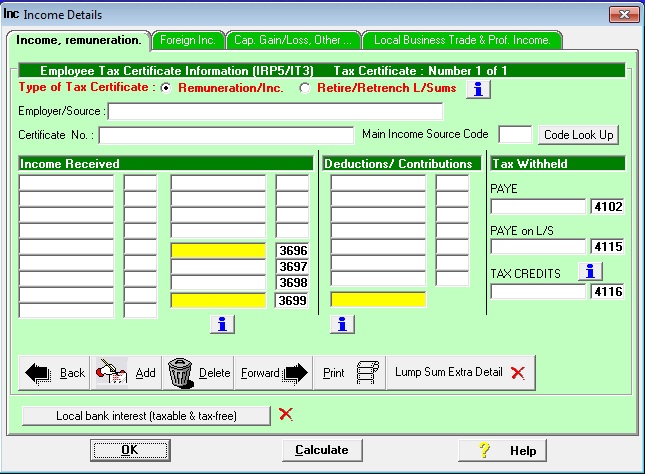

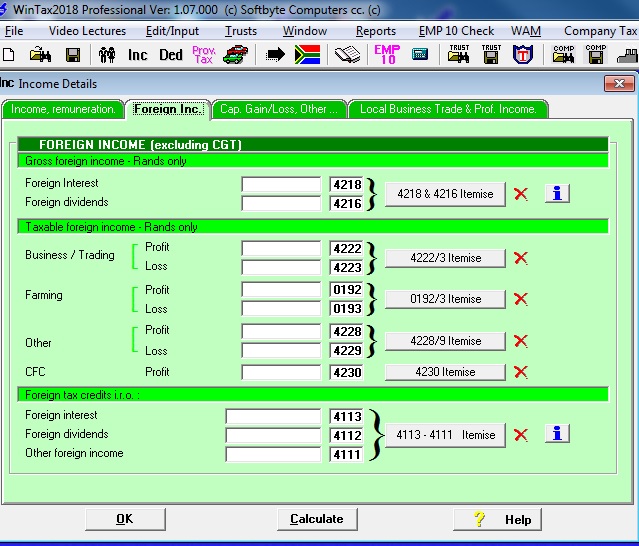

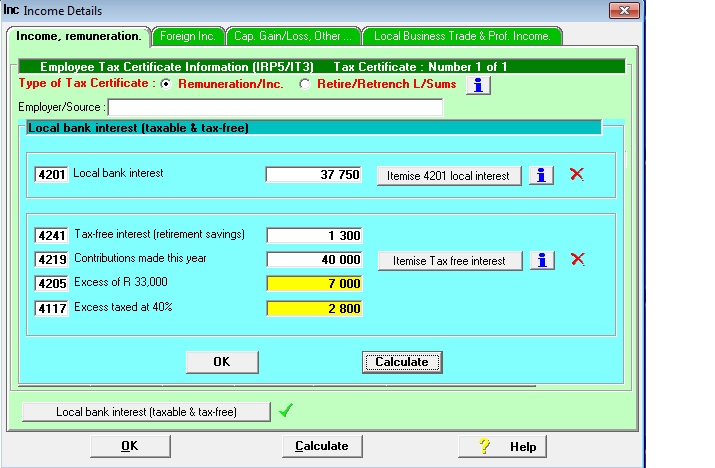

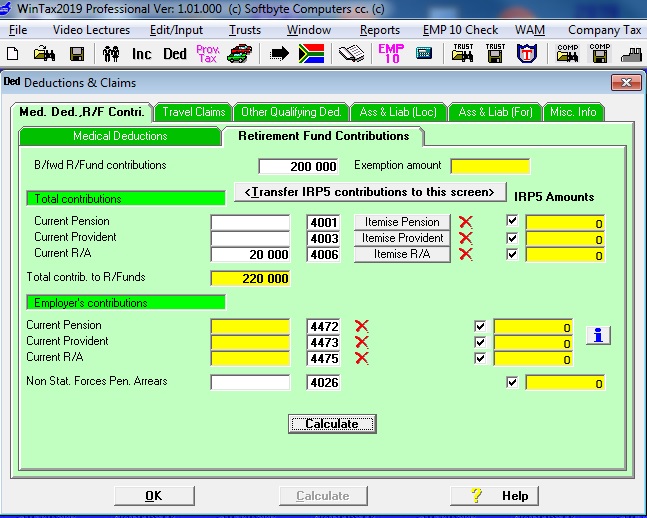

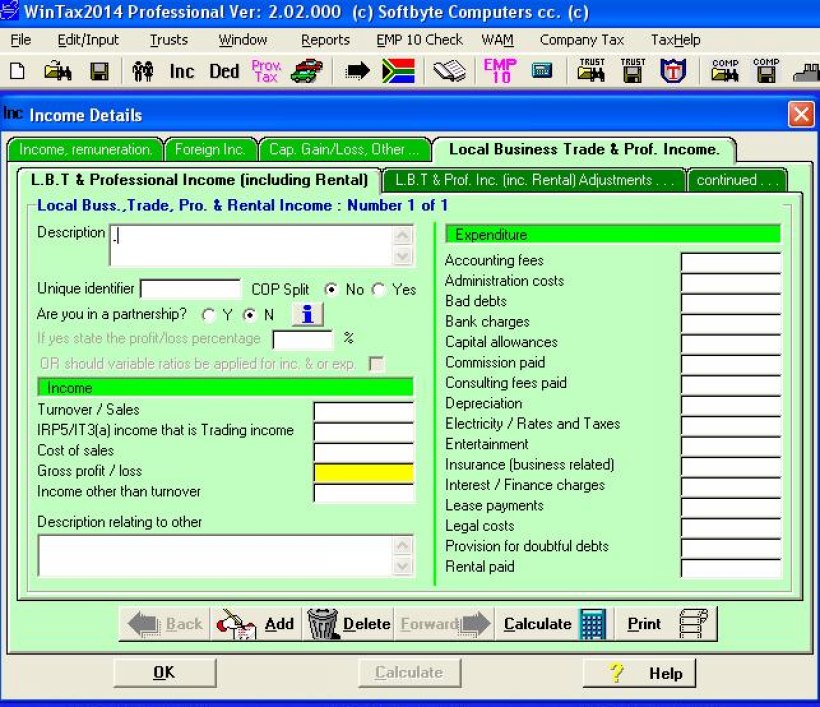

A few of the WinTax screens are displayed here. Click on the pictures to enlarge them.

The new WinTax Income screens are designed to match the look of IRP5 and IT3 tax certificates. Capture as many Remuneration and Income (IRP5) and IT3 tax certificates as you wish. Move and locate the handy Auto Summary window anywhere on the screen. If you change any amounts on any of the income or deduction screens then the “bottom-line” amounts in the Auto-Summary window are automatically, and instantly, changed.

Foreign income screen with “info” tax-tips explaining these laws including forfeited amounts and s6quat limits for offshore taxes claimed etc – all calculated for you – including the complex s6quat calculation used to claim foreign tax deducted offshore on foreign Capital Gains! All the new ‘taxation of foreign dividend laws’ automatically calculated for you and the calculations are explained in the on-screen “i=info” help buttons and accredited tax-lecture videos.

The new “tax-free interest” Retirement Savings Plan (with over-subscription taxes) is comprehensively catered for in WinTax.

The Deductions screen with contributions automatically transferred from the IRP5 screen. “info” buttons display handy tax tips, where to enter what, how it will affect your tax etc. WinTax2019 screen displayed here showing contributions for R/Funds with the facility to itemise different funds etc. SARS’s new changes, with regard to what amounts are now assigned to which source codes for R/Fund contributions, are fully catered for in WinTax.

The new Retirement Fund Advantage calculator added to WinTax2018 and WinTax2019. The on-screen HELP and the set of on-screen accredited videos explain everything you ever wanted to know about the new R/Fund laws including how much of the allowable contributions SARS is willing to pay etc.

The new “Use of company vehicle” fringe benefit claim calculator shows and explains SARS’s errors with these claims. Handy “info” tax-tips buttons and accredited video lectures explain everything you ever wanted to know. The claim calculator also caters for multiple cars and operating leases. Claims calculated here are automatically credited against taxable income in the main assessment calculation.

The Provisional Estimates screen shows all estimates for all periods all on one page. New on-screen “MTC” calculator works out all the additional medical tax credits you can claim to reduce the provisional tax payment required (WinTax2018 screen illustrated).

The medical aid contribution claims screen caters for the new tax credit laws. (A taxpayer not yet 65 and with R 20,000 medical expenses, medical aid fund contributions of R80,000 split 50/50 between employer and employee, taxable income of R340,000 illustrated here in WinTax2017). The new “info” tax tip buttons explain exactly how these credits are calculated and how everything works. All tax credits are automatically utilised in the assessment.

Check daily, fortnightly, weekly, monthly wage and annual IRP5 amounts including the new tax credit amounts and limits for contributions to R/Funds. WinTax2017 screen shown here.

WinTax Taxation of Withdrawal-Benefit and/or Retirement-Benefit Lump Sums from Retirement Funds using SARS’s “accumulative” method of taxing multiple lump sums taken in the same tax year or over different tax years. All the new changes to tables in WinTax.

The CGT Register & Calculator allows you to enter as many Capital Gain transactions as you wish. “info” tax-tip buttons and a host of on-screen accredited video tax lectures explain what to enter where as well as explaining all aspects of CGT). Enter, and itemise, or list, list known Capital Gains from Trusts or investment fund certificates or use the comprehensive calculator to display the gains for disposal of a primary residence, other assets such as 2nd properties, small business sale etc. The CGT calculator allows you to calculate the gain for all three methods allowed by SARS; appraised value, Time Apportioned Base cost or 20%/80% method). No limit to the number of transaction you may add. The calculator even caters for partnerships and “residency period” scenarios. All exemptions, exclusions and inclusion amounts are calculated for you and the correct amount is added to income to be taxed at normal rates. CGT losses are automatically carried forward.

Travel claim calculator with handy “info” tax-tips and accredited tax-lecture videos to explain how travel claims work. The calculator caters for cases where the taxpayer received a travel allowance from the employer for using their own car and also for cases where a taxpayer never received a travel allowance but is entitled to claim for motoring expenses for using their own car.