SoftFin

We have been in the business of producing software for financial consultants for over 35 years and one thing we have learned is that there is no single software program out there that does everything that all consultants require. Consultants usually make use of 2 or 3 different software programs to draw up financial plans. SoftFin should definitely be one of those programs.

Comments from a few SoftFin users…

I have lost count of how many investment deals SoftFin has closed for me over the years. My business would never have reached the heights it has without the help of SoftFin. Tony Archer – Financial Advisor (Klerksdorp)

SoftFin is, and always has been, my choice of financial software. Your support is excellent! Tony Calitz – Financial Consultant (Durban)

After 30 odd years in the Financial Services Industry, I think SoftFin is a remarkable program with no equal and I don’t really understand why it is not used by every financial consultant. Paul Wood (Cape Town)

I have been using your software for +- 15 years and, despite all the competition and products on the market, I have stayed with Softbyte Computers and SoftFin because you produce the software we brokers need and you back it up with service 2nd to none! It is rare indeed to find a service orientated business as yourselves these days. Thomas Labuschagne (Pretoria)

Download and install SoftFin right now! SoftFin will make you more professional, save you time, make your life easier and make you more money. The license fee for using SoftFin is only R750(incl.VAT) a year – and the cost is fully tax-deductible!

That’s right – only R750 a year – NOT R750 a month!

A special “try before you buy” 30-day trial copy is available on application. Call Nick on 082 453 7632.

Scroll a bit further down this web page and watch a short video explaining SoftFin’s calculators that you will use every day of the week. Then scroll right down to the very bottom of this web page to see a short video explaining SoftFin’s ‘simple-to-use’ Needs Analyses.

If you have any queries, or if you need any help downloading and installing SoftFin then call Nick on 011 794 8361 or 082 453 7632 who will gladly help you.

Watch this 10-minute video to see details of some of SoftFin calculators designed to help you in your business as a financial consultant. Here are the tools you need to save you time, to help you give clients the best advice possible and to help you close deals and make money.

You can expand the size of the video for a higher-definition picture. You will need sound for the video. If your pc does not have speakers then plug your cell-phone’s “ear-bud” ear-phones into the green jack on your computer.

Watch the video, at the bottom of this web page, for a detailed explanation on SoftFin’s compliant Needs Analyses and how they work.

Softbyte Computers (Established 1983) has been developing and selling tax and financial planning/calculator software to brokers, tax and financial consultants for decades. Some of our biggest customers include SA’s largest financial institutions like ABSA, NEDCOR, STANDARD TRUST etc and Old Mutual have bought a license agreement to use our WinTax tax and financial calculator/planning software every year for the past 21 years in a row. If you have even a passing interest in any form of finance, banking, life assurance or investments then you cannot afford to be without a copy of SoftFin on your computer. You will use it every day of the week.

SoftFin includes quick 15-minute FNA’s, client/policy/fna database, policy schedule reports, quotation packages and everything else that a financial planner needs every day of the week.

SoftFin relies on simple calculations to display and explain the need for investing for the future better than anything else out there. If you use life assurance or investment products to secure the financial future of your clients then SoftFin closes deals like nothing else. SoftFin’s annual license renewal fee is R750.00 (incl.VAT) which is completely tax-deductible. This means that SARS will pay a huge portion of the cost of SoftFin for you! Think about it – if only one of the options in SoftFin helps you close only one deal a year then SoftFin will be the best program on your computer! The secret of SoftFin’s success is that it works on the principle that what is simplest works best. SoftFin’s simple calculations, graphs, amortisation statements and single-page FNA reports are easy enough for a child to understand. SoftFin is also updated regularly, free of charge, with new and additional features (the new “Estate Duty Estimator” calculator, the “R/Fund Advantage Calculator and the “Draw-Down Annuity” calculators were recently added to SoftFin (FREE OF CHARGE).

Click on any of the thumbnail pictures on this web page to expand the picture in size.

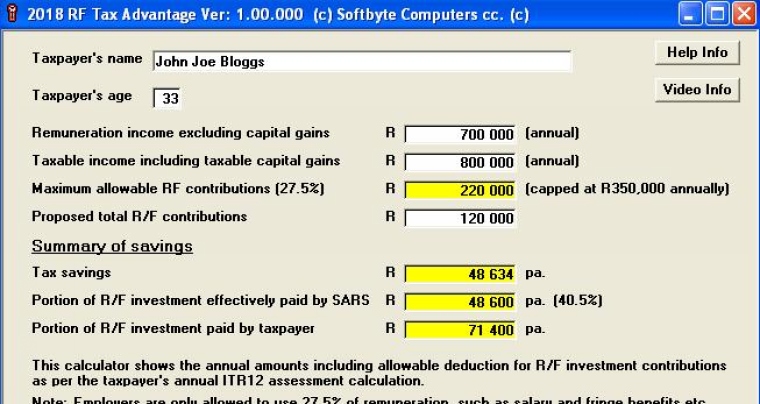

The new RF Advantage calculator

This new “RF Advantage” program explains how to arrive at the correct amounts and will explain exactly what portion of any proposed RF contributions will be paid by SARS! In many cases SARS will pay over 40% of contributions for the taxpayer. The program is totally convincing to any taxpayer. There is no other sales-aid out there that works so well in convincing a client of the advantages of investing in retirement funds. The on-screen HELP and the set of short video tax lectures, accessible on-screen, explain everything you ever wanted to know about the new Retirement Fund contribution laws and the huge tax and financial benefits associated with R/F contributions. If this program works only once for you, and sells only one R/A then it will pay for SoftFin many, many times over.

You only have to enter three amounts onto the screen and the on-screen HELP and the tax lectures videos will tell you EXACTLY what you need to enter for remuneration and EXACTLY what amount you need to enter for taxable income. The calculator will show, in this example, that SARS will be paying 40.5% of the retirement fund contributions for the taxpayer. In this example, the taxpayer will retire with a full pension plan that R120,000 a year in contributions bought but having only paid only R71,400 a year for it. SARS will have generously paid the balance of R48,500 a year for the taxpayer. Change the contribution amount, the remuneration or taxable income amounts and instantly display the new savings and percentages etc. Print the report and/or email it.

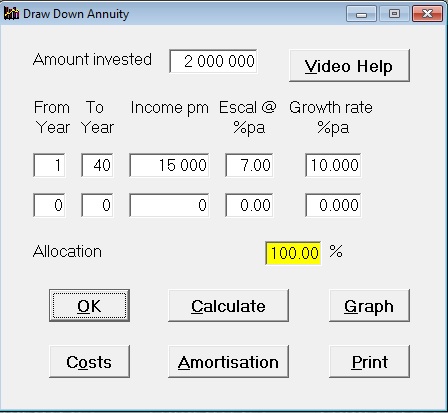

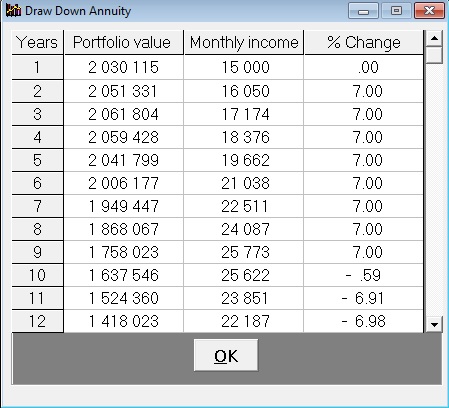

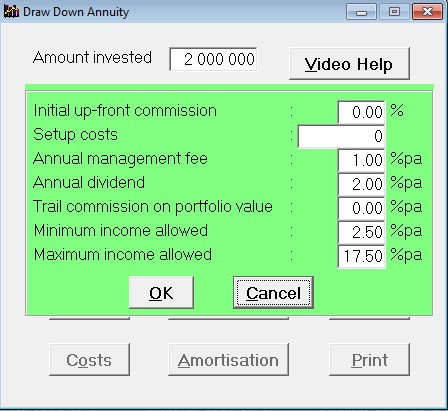

Draw-Down Living Annuities

Show the progress of capital and income drawn. Use this calculator to show your clients exactly why they cannot draw an unrealistic income from a Living Annuity. This option offers advice on how to get the inflation-linked income you want for a much longer period! Configure any costs, commissions, growth rates etc. Full colour 3-D graphs plus amortizations.

Watch this video to see how you can use a little financial planning to dramatically increase the time that a client can draw escalating income from a Living Annuity. Everybody wins here! The clients gets more income for a longer period and more capital stays in the Annuity Fund for longer! This video shows exactly how this Draw-Down Living Annuity calculator works.

You can expand the size of the video for a higher-definition picture. You will need sound to view the video. If your computer does not have speakers then plug your cell-phone’s “ear-bud” earphones into the green jack on your computer.

Scroll right down to the bottom of this web page to view the video explaining SoftFin’s ‘simple-to-use’ Needs Analyses.

Many of SoftFin’s calculators allow you to make direct comparisons between the returns offered by different types of investments.You can direct any SoftFin report either straight to the printer or export the report to a word processor or spreadsheet file where you can customise the report in any way you wish and even email the finished report to the client as an attachment.

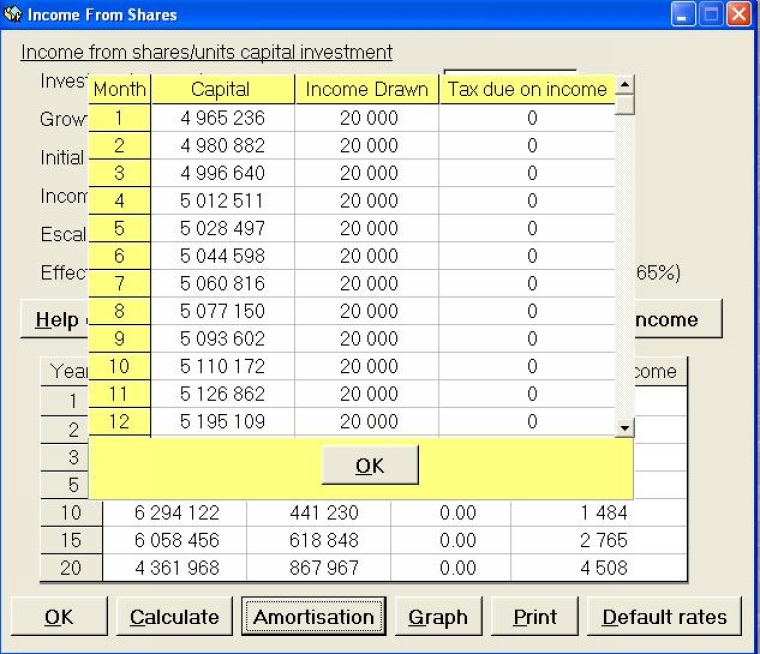

A new addition to SoftFin’s calculators is this “Income from share capital” option such as the investments offered by big investment houses who place your client’s money in a basket of Unit Trust/Mutual Funds. You can enter projected growth rates, amount of income required drawn monthly or annually etc. You can set all Default Rates (admin costs/fees, commissions etc). You can see from the, 20-year table, exactly how much income the investor will receive as income at any stage, the remaining capital at any stage and, by changing growth rates, percentages of income drawn, income escalation etc and you can see for exactly how long the investor’s capital will provide income. Change projected growth rates, change income drawn, change escalation factor on income drawn and the 1-20 year table instantly tracks and displays available investment capital remaining at any year plus income at any year and CGT payable on disposal of shares etc. Avoid the tragic consequences of the investor running out of capital and income too soon! “HELP” buttons explain implications of interest earned and the implications of CGT on shares disposed of to produce income. Plus you also get a version of this option as a free app for your Android phone or tablet.

The amortisation button allows you to drill down and view each and every month in detail (up to 600 months or 50 years).

3-D graphs print in full colour and can be used to enhance any printed reports. Export the graphs to WORD or any other Windows software – or click and paste the graph picture straight into an email.

Kwik-Quotes

Struggling to get quotes from Life Assurance companies for maturity values for their investment policies? So how are you supposed to sell these products? How do you convince someone to buy an R/A, for example, if you cannot show them what their investment will be worth when they retire? SoftFin’s remarkable “Kwik-Quotes” option allows you to produce your own quotes for any investment policy/product from any company. Our experience working with actuaries and developing software quotation systems for Life Assurance and investment companies means we are now able to give you your own quotation system in SoftFin.

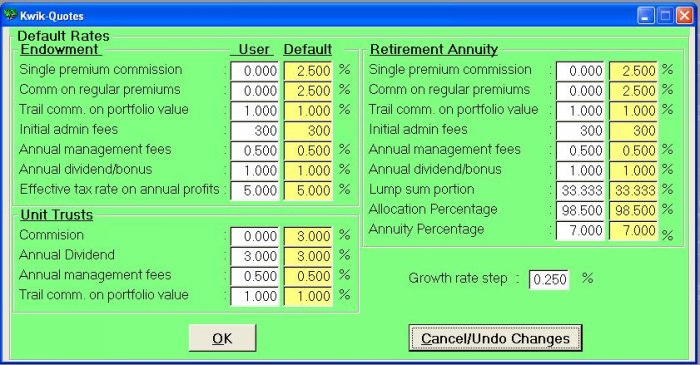

Calculate and compare maturity values from Endowment type, Retirement Annuity/ superannuation type, Unit Trust/Mutual Fund type and bank investments on the same screen, detailed amortisation’s and full colour 3-D rotating graphs. Produce maturity values for investments/policies at any growth rate you like. Also show totals of escalating premiums paid! Instantly switch between investment types at the click of a mouse to compare maturity values. Click on the UP/DOWN spin buttons to scroll the period or the growth rate and see the maturity values scroll simultaneously.

SoftFin allows you to configure commissions (including Trail comm), costings, fees, dividend rates etc yourself for any type of investment/policy to allow you to produce super-accurate ”Kwik-Quotes“ for investment/policy products from any investment company. “Average” default figures are supplied but you can setup the SoftFin program with any values you require for specific products from specific life assurance companies or investment funds and you can save these values to use again or you can restore the default values anytime. Any product from Endowment type policies to Unit Trust/Mutual Fund, R/A or superannuation schemes – produce your own quotes instantly with SoftFin. Plus you also get a free version of this option as an app for your Android phone or tablet.

Simple Estate Duty Estimator

A quick calculator to estimate estate duty and executor’s fees for a client by entering no more than 7 or 8 amounts. On-screen HELP tells what to enter and where.

Ever wanted a simple calculator that you can use to enter half a dozen figures to calculate and show an estimate of Estate Duty and Executor’s fees without using a complex 20-page spreadsheet-program? Using such a complex 20-page program often involves spending ages trying to get all the relevant information out of the client just to get an estimate of duty and fees. Financial planners want a quick 10-minute tool to be able to show a client whether they would be facing death-duty fees of R1,000 or R1,000,000 and how some simple estate planning could save high net-worth clients paying the state and executors a fortune. The new Estate Duty Estimator in SoftFin is just what many tax planners and financial planners have been looking for and they will agree that this update adds extra value to SoftFin. Of course any figures in the Estate Duty Estimator can be saved in the SoftFin database, under the client’s name, retrieved, edited and printed (with a disclaimer that the client can sign to protect you).

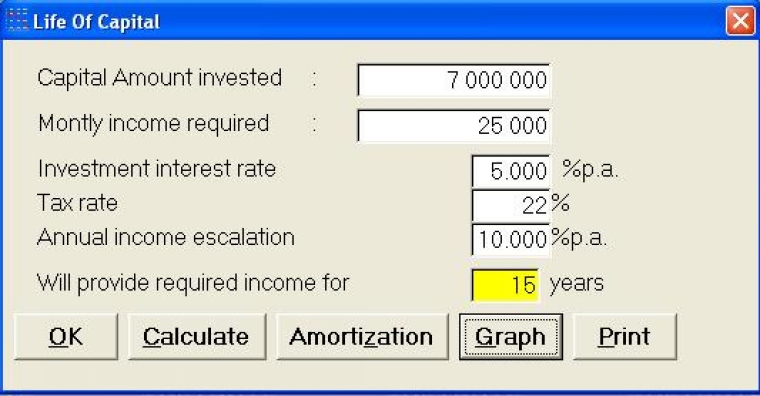

Life of Invested Capital

Similarly, placing our Lotto winnings of R7m in the bank at 5% pa and drawing R25,000 a month escalating at 10% pa with an average rate of tax of 22% on the interest earned shows the capital and interest all gone in 15 years. Use the amortization to check the cash-flow statement details and use the graph option to enhance the visual effect.

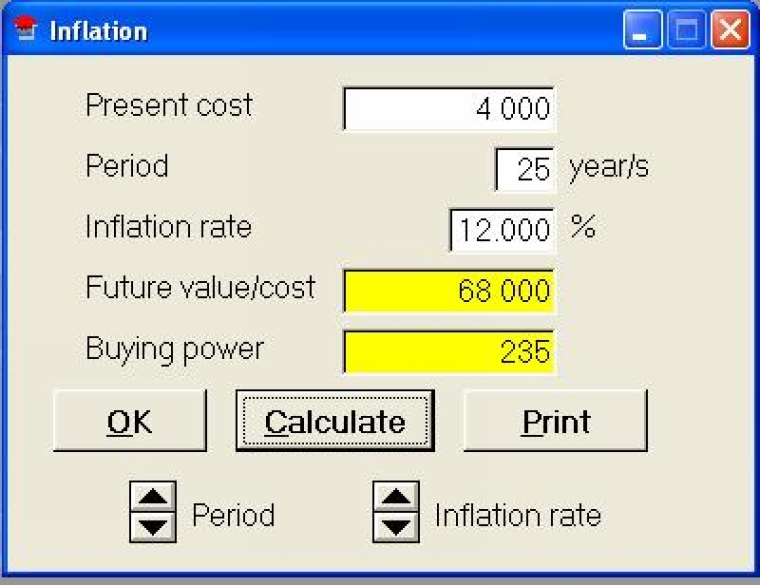

Inflation (or forward-cost) projections

Show how an item costing R 4,000 a month today (eg food or rent) will cost R 68,000 a month in 25 year’s time if inflation is 12% pa. The calculator also show what R 4,000 will be worth in 25 years. Enter any values you like and use the spin buttons to scroll the escalation rate or the period and the answers scroll at the same time. This proves to your clients just how vital it is to invest for the future. Will your pension pay all the bills when you retire? Do you even have any idea what those bills will amount to when you retire?This calculator will show you the surprising truth in an instant. Plus you also get a version of this option as a free app for your Android phone or tablet!

SoftFin includes access to video Help lectures

SoftFin also includes access to 14 accredited video help lectures for serious financial planners. The videos include subjects such as “Annuities and how they work”, “Investments & Tax”, “Capital Gains Tax” and “Taxation of Lump sums”. These videos are not a gimmick. These accredited videos are part of a package of accredited WinTax video lectures.

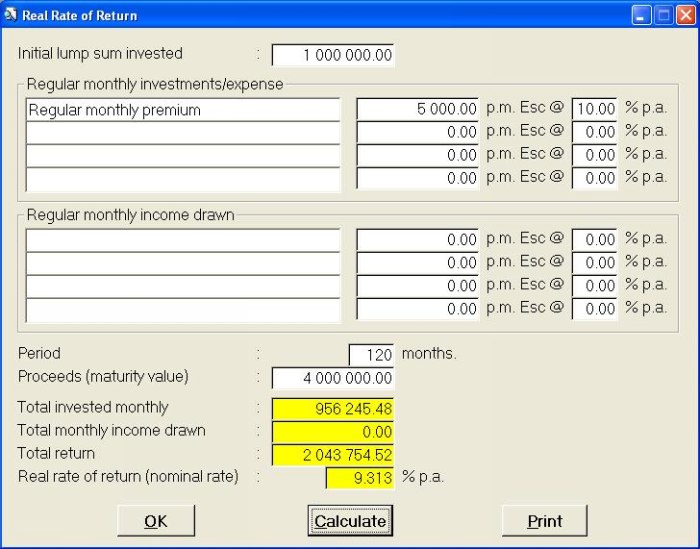

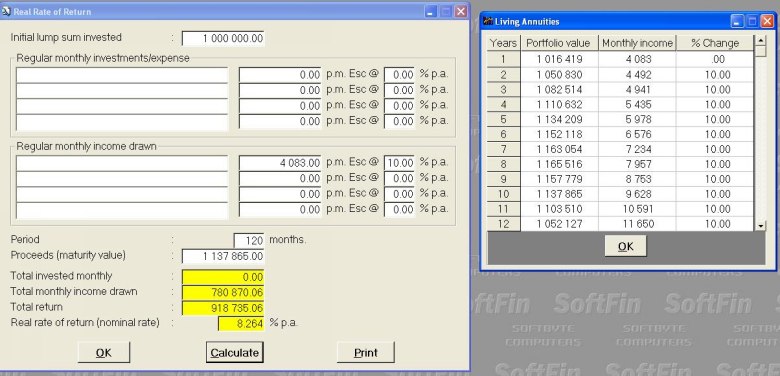

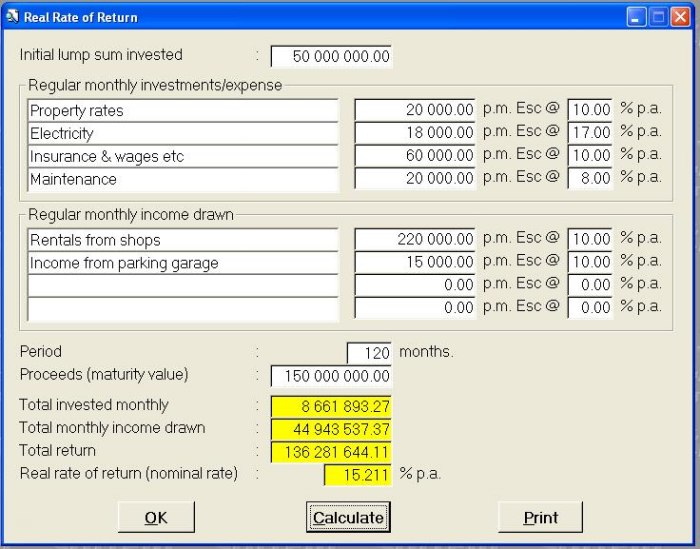

Real Rate of Return

The new Real Rate of Return (RRR) calculator will show the Real Rate of Return achieved on any type of investment. No commissions or charges are taken into account by the RRR program which shows the Real Rate of Return on the actual investment amounts or premium/s you paid and not on your premiums less commissions and admin charges etc. The RRR program displays the true (nominal) rate of return which you received on your investment by using a nominal rate and compounding interest monthly. The program has recently been improved considerably to cater not only for calculating the real rate of return on financial instruments but for any type of investment project such as building projects, real estate developments etc.

In this picture we show how we invested R 1m in a financial instrument (investment policy or share fund) for 10 years and we added a regular monthly premium of R 5,000 escalating at 10% pa. The Real Rate of Return calculator shows us that when the investment product matured for R 4m after 10 years the Real Rate of Return on the investment was 9.313%.

Let’s say we invested R 1 million into a Living Annuity 10 years ago and the statement we just received from the fund shows us that our portfolio is worth R 1,137,865 today. This in spite of drawing monthly income starting at R 4,083 pm 10 years ago and increasing annually at 10% pa. Our calculator shows us that the Real Rate of Return on the Living Annuity has been 8.264%.

In this example we need to know whether a property deal, under consideration, would be a viable proposition or would we be better off investing in something else. The plan is to invest 50 million in buying a shopping centre and then selling it after 10 years for 3 times the cost price. Considering regular expenses such as utilities, rates & taxes, electricity, maintenance etc and considering income from renting out shops and floor-space etc, what would our projected rate of return be? It is quite obvious that this calculator, alone, in SoftFin could save many project managers and real estate developers millions. If you receive an offer to buy a building, or even an asset, this calculator will tell you what your real rate of return would be.

Other SoftFin calculators

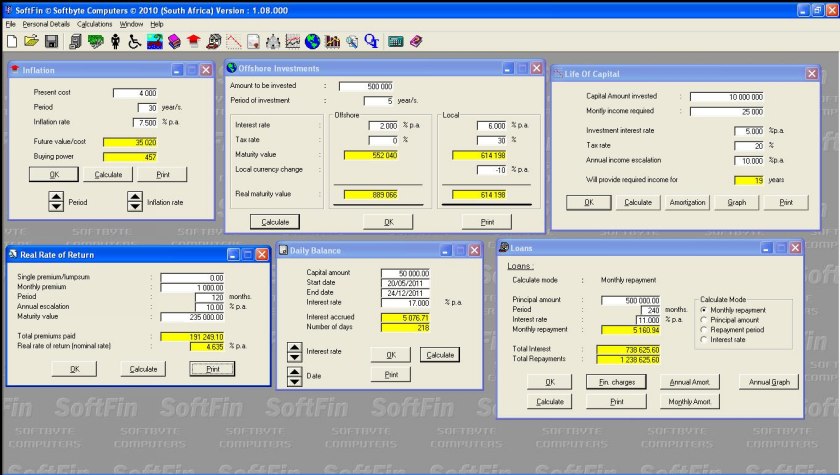

Here are sample screens for just 6 of the other 19 calculators available in the SoftFin program to help you draw up financial plans for clients. These are calculators you will find so useful you will use them every day.

Some of SoftFin’s useful financial calculators which you will use every day are…

- Compare after-tax monthly income between purchased annuities and fixed deposit.

- Living annuity income projections.

- Compare income between investing offshore and locally – factoring in tax and Rand slide etc.

- Life of bank-investment capital drawing income with tax & inflation considered.

- Life of capital invested in a “basket” of Unit Trust/Mutual Funds showing income drawn, CGT payable etc.

- Three different program options relating to loans.

- Inflation projections.

- Daily balance and nominal to effective calculators.

- Debt consolidation.

- Quick Tax shows tax committment as well as average tax rates before and after rebates etc.

- Plus more financial calculators and features.

- Note that many of these calculators come with amortisations and full-colour 3D graphs.

SoftFin includes a fully comprehensive client-details database storing all the personal particulars for the client, spouse and children. Save all needs analysis projects and exercises for death, retirement, disability or education planning.

If you are the slightest bit interested in finance/investments then you cannot afford to be without SoftFin. If you are in the business of selling investments or insurance, then SoftFin is a “must have” sales aid. SoftFin is so simple, easy to use and understand and no other software can boast SoftFin’s success rate in selling investments and policies by showing up shortfalls in financial planning so simply and effectively. SoftFin believes that what is simplest works best.

SoftFin Quick FNA/INA (15 minutes)

SoftFin has, without doubt, quickest, and easiest-to-understand Needs Analysis modules that explain, in the simplest way, exactly why, and how much, you need to invest to cover shortfalls for death, disability, retirement or education planning. SoftFin provides simple, computerised Needs Analyses (done in 15 minutes) with a single-page report everybody can understand. Why baffle your clients with a more complicated software package which takes days to gather and capture information only to produce a 30-page report that nobody really understands? 95% of your clients don’t need, nor will they understand, a 30-page report from a fully comprehensive needs analysis. Reports like that will probably scare your client away. SoftFin offers a simple, compliant, needs analysis done in 15 minutes and SoftFin produces a simple report on one page. This is a dream come true for brokers. SoftFin is comprehensive enough to cater for different income amounts required for different periods and different income amounts available over different periods. SoftFin works in line with international compliance regulations (including strict compliance regulations in place in South Africa).

Financial consultants all agree that a single software program which will serve all of their requirements simply does not exist. They all use two or three different software packages to prepare presentations and SoftFin should definitely be one of those programs.

There is no other program for brokers out there that comes close to matching SoftFin when it comes to…

- Oh so easy to use

- Making a broker’s life easier

- Proving to a client the need for investing

- Oh so easy to understand

- Speed

- Power

- Flexibility

You may save each individual needs analysis in SoftFin’s database for retrieval, reviewing, editing, printing anytime. Search the database for assessments last reviewed between dates you specify or assessments to be reviewed in future between dates you specify. There is no limit to the number of records you may save in the database.

SoftFin will help you do complex financial and investment planning exercises in seconds. SoftFin is produced by a company which is completely independent from any financial institution and so SoftFin is absolutely unbiased when it comes to giving the best advice on finance and investments. We have been in the business of writing financial planning software for over 30 years and we know exactly what financial advisors need in a software package of this nature. SoftFin is the kind of package that brokers and financial consultants have been crying for. A financial planning and income needs analysis program which is…

- Super quick

- Oh-so-easy to use and understand.

- Produce your own quotes for any policy/investment type.

- Comes with no ties or commitments to any life assurance company.

- Produces reports so simple that even your clients can understand them.

- A program which really works for you.

No other software out there will close deals like SoftFin. Users claim that SoftFin pays for itself over and over again every month.

The FNA screens in SoftFin

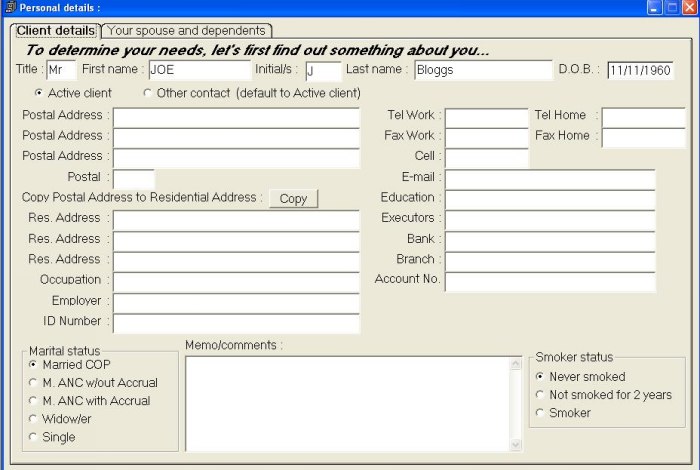

The program allows you to enter all your clients’ details – and also details for spouse and children. You can search for things like birthdays, review dates etc.

You can perform a simple and quick needs analysis for Death, Disability or Retirement planning. The program provides a step between doing nothing for your client and doing a massive, full and comprehensive, needs analysis requiring hours or days of work in order to produce a 20-page analysis report that nobody can understand.

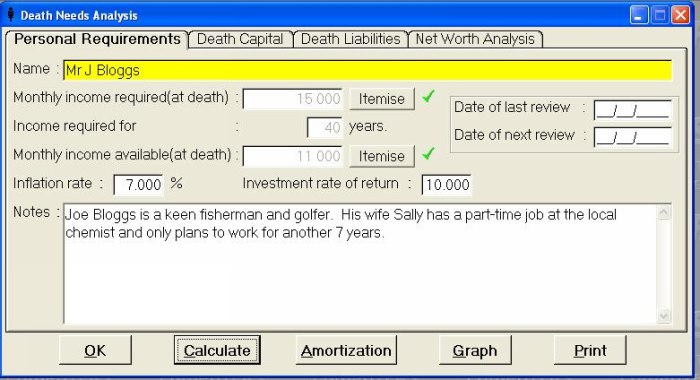

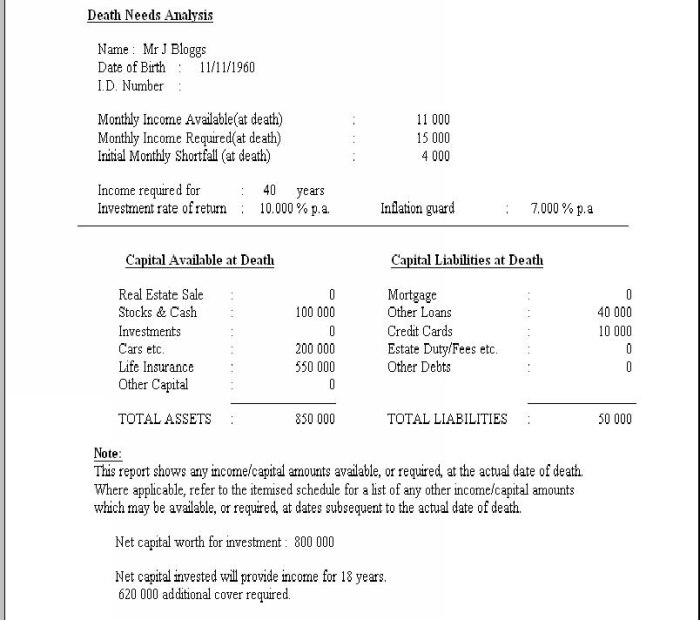

You can do a needs analysis in 15 minutes and give the client a single-page report – a report so simple that anyone can understand it! Let’s go through a Death Needs Analysis for Joe Blogs. The programs asks what income the widow will need, if the husband dies today, in order to carry on a normal life and what income the widow would actually have. The program works out what the widow will have left over to invest to provide that income and the program will calculate additional capital required, by way of life insurance, needed to invest to provide that income. Everything is laid out in totally simple formats.

The Death INA screen uses TABS at the top of the window to open pages allowing you to enter the widow’s requirements, capital available at death, liabilities to be settled and the final analysis. The program allows you to enter an amount for Monthly income required(at death) inflation-linked at a certain percentage for a certain period or you can click on the Itemise buttons to elaborate if needed. See the screen picture below where we elaborate on the monthly income amounts required after the death of the husband.

We can see that the widow says she needs 15,000 per month for the first 8 years (year 1 to 8), 14,000 a month for the next 8 years (year 9 to 16) and 11,000 from year 17 to year 40. OK, it is agreed that, with inflation, the widow will need a lot more 14,000 pm in 9 years but the program will take care of that automatically. You enter the amounts in today’s values, for simplicity, and the program does all the projections for you. You can enter as many periods and different income amounts as you wish all escalating at whatever rates you wish. The itemised grids allow an unlimited number of lines for entering periods and amounts. Note that we use year 1 as the year of death and we enter the amounts required as today’s values. The program will automatically factor in inflation rates. We have also said here that the client and widow estimate the inflation rate to be 7% pa and the rate of return on any capital invested would be 10% pa. You will see where these figures come into play later but remember that you can enter any figures and values you like here. The program works for any country and any currency.

Monthly Income available to the widow after death can also be itemised in a grid. Here we can see the widow currently earns 6,000 a month salary but she only intends working for another 7 years. Her salary increases by 10% a year. There is also rental income from another property, currently paying 5,000 but increasing at 10% pa and she intends to continue renting out the property. You can enter as many periods and different income amounts as you wish all escalating at whatever rates you wish. The itemised grids allow an unlimited number of lines for entering periods and amounts. Note that we use year 1 as the year of death.

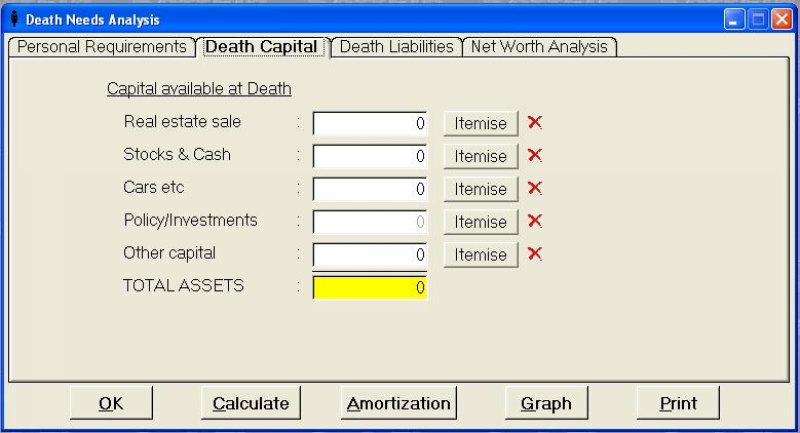

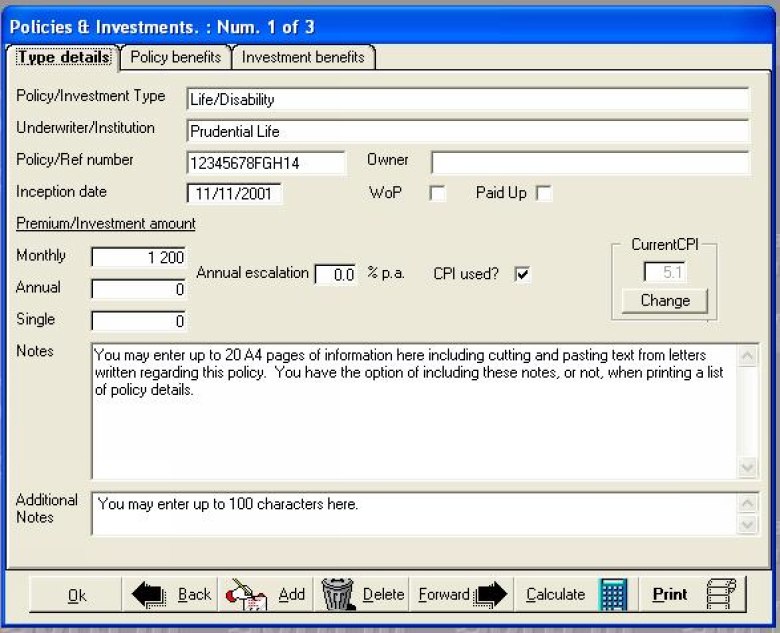

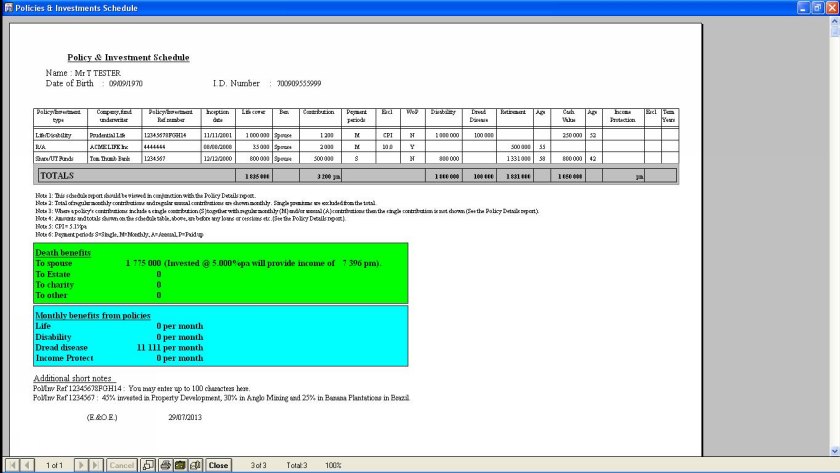

You can enter total amounts in the fields provided on this screen, or click on Itemise to itemise various amounts and their sources in itemise grids. If you do Itemise details then the red cross will change to a green tick reminding you that you have data itemised. The program does not insist on all the information for policies or investments being entered such as inception date, waiver of premium etc. All the program needs you to enter, in order to do a simple analysis, is the benefit amount that will be paid out. If you itemise Policies/Investments then the screen below will open where you can enter policy and investment details.

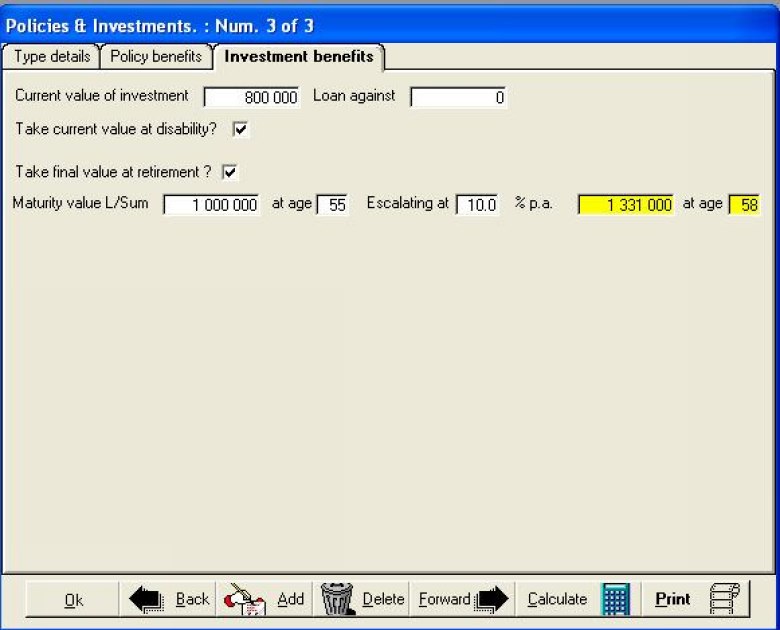

The Policy/Investment window has 3 sections formed by 3 TABs across the top of the window. This first TAB allows the user to enter the type of policy/investment and premium/s. This where you enter what the client puts into the policy/investment and the next TAB screen shows what the client will get out of the policy/investment. You do not have to enter anything on this screen in order to do a simple Needs Analysis, you only need to enter the benefit/s on the following screen such as life cover, disability benefit, R/A maturity value etc. The ‘Notes’ page/window field will hold up to twenty A4 pages of text including text cut & pasted from MS-WORD and other Windows programs. The ‘Additional notes’ field will take up to 100 characters and this info will appear on the schedule. You can add as many policies/investments for a client as you wish. There is no limit. Just click on the Add button at the bottom of the window to add more policies or investments. Use the ‘Back’ and ‘Forward’ buttons to scroll between policies/investments, edit, alter, delete or print policy/investment details or print lists of policies/investments or schedules.

On this screen you enter the benefits from the policy. Add as many policies as you wish for the client – there is no limit! If the policy you add has a death benefit and a cash value as well as a Disability benefit then you enter all the benefits on the one screen. All the benefits for this policy are shown, at a glance, on one screen. If a policy has a particular benefit then enter it here. If a policy does not have a particular benefit then simply leave that field blank. Note that, to do simple Needs Analysis for death, all you need to enter is the death benefit on this screen and nothing else. The quick analysis does not need any other information besides the death benefit amount – and the same goes for a Needs Analysis for Disability or for Retirement planning. There are no compulsory fields to stop, or slow down, your progress. Of course if you do enter more data on this screen then more powerful options become available. Existing cash values and R/A maturity values etc are projected forwards and backwards automatically as you change the retirement age in the Retirement Needs Analysis to find the best year to retire. Use other software such as Astute, or printouts from Life Assurers, showing Maturity Values of the client’s products and use the “projections” option in SoftFin to show those Maturity Values at any age you want them to be entered here. These screens offer the ultimate in flexibility when doing Needs Analyses. This is so easy that one of our users said it should be called “FNA’s for Dummies.”

The client’s investments can be added as well. Enter the benefit amount/s here and they will be used in the analyses where needed.

Like all other reports, the Policy/Investment schedule can be viewed on the screen, printed to the printer or exported to any other format such as MS-WORD etc.

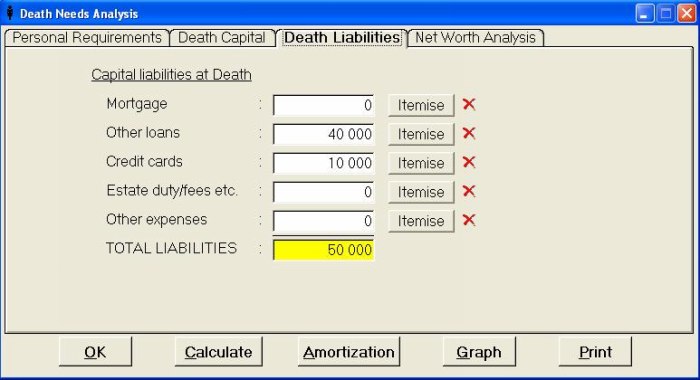

You can enter total amounts in the column provided on this screen or you can itemise these “totals” in itemise grids. You can even go so far as to say the widow has always planned a shopping trip to Paris in 10 year’s time. Use the Inflation projections option to calculate the cost of the trip in 10 year’s time and enter it in the Itemise grid for Other expenses in year 10. The program will ensure that there is enough money provided to cover such an expense in year 10.

And that’s it!!! All done in a few minutes!!

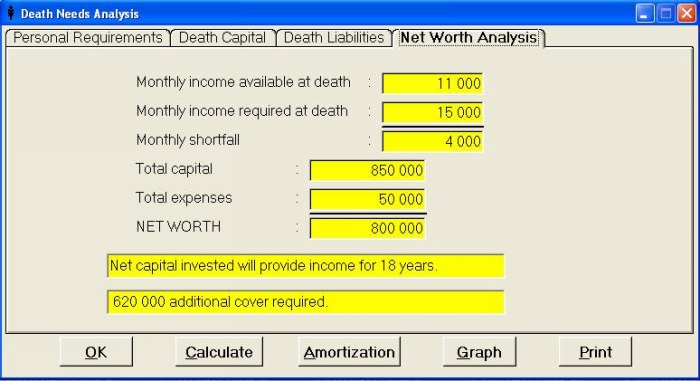

The Net Worth Analysis shows what the widow will need every month, what she will have every month and exactly long what she will have will provide the income she needs every month. In this case the 800,000 net capital invested at 10% (we said we could expect 10% on investments) will only provide the income required for 18 years. Note that, if the program finds that this clients is over insured then the program shows the amount by which they are over insured. Maybe the client would wish to invest this excess amount into his retirement plan?

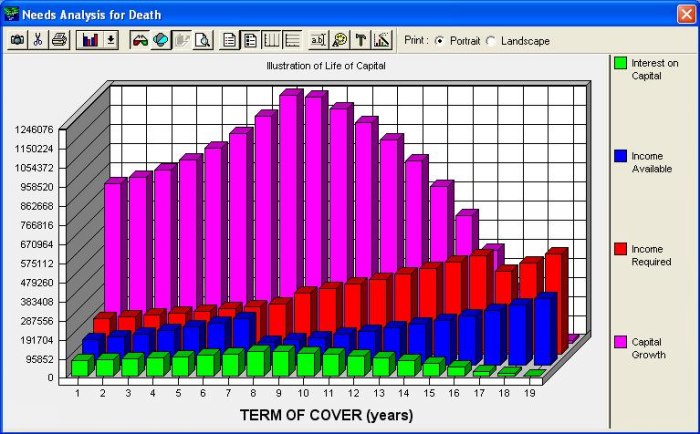

Simply clicking on the Amortization button displays a year-by-year table…

Notice how the income available increases every year up to year 7 and then drops in year 8. Remember that the widow said she only intends working for 7 years. The income from year 8 onwards is made up of the property rental plus income from the invested capital. Remember we said that, in year 9, the income required would be 14,000 pm (168,000 per year). We also said inflation was 7% so the program has worked that the amount we will actually require in year 9 will be 308,861 pa and not 168,000 pa. The program has worked all this out for us. Pick up a calculator and punch in 168,000 and then +7% nine times to check the program’s figure of 308,861 pa income required in year 9.

A simpler way is to superimpose the program’s Inflation projector window over this screen and check any of the figures as shown here. The program’s calculations cannot be questioned. Your client can simply pick up a calculator and check all the amounts shown in this table. If your client gives you all the figures to enter, and he agrees with the simple calculations, how can your client then doubt the final answers?

The single-page report!

The single-page report printout shows the simple analysis and can be backed up with an amortization printout, reports showing all itemised entries as well as a 3-D color graph. All reports can be directed straight to your printer or saved to a disk file and exported to any format such as WORD or XL and modified or customised in any way you wish and then printed or even emailed to the client.

Of course we can now go to the Capital screen and enter a proposed extra policy payout for the shortfall of 620,000 and we will see that the extra investment would now provide all the income required for the 40 years requested. Go back and change any amounts, click on Calculate and immediately see the new answers. You can even give the client two printed reports; one without the extra life cover and one with the extra life cover.

The 3-D color graphs can be rotated in any direction, the style of the graph can be changed ie from bar chart to a line graph etc. The graph can also be copied here and pasted directly into the middle of a presentation in WORD etc.

Note that the program will also do a needs analysis for Disability and an analysis for Retirement Planning using the same simple methods.

Watch this video HELP explaining how to use the simple FNA’s

(You can expand the size of the video for a higher-definition picture)