BackTax

Salary designing and optimizing software.

BackTax for the tax year 1st March to 28th February will be released within a few days of the budget being read in February.

(BackTax is also fully tax-deductible!)

Although BackTax is written to work under Microsoft Windows operating systems, if you install BackTax on a Cloud then BackTax can be accessed, and used, on any device from Windows PC’s, AppleMac, Android and IOS phones and tablets etc.

How does BackTax work? Normally, you enter the salary and fringe benefits into a tax program and the tax program works out the tax, UIF, SDL, medical tax credits etc. Of course BackTax will do all this for you but BackTax can also work backwards. One of the options in BackTax allows you to enter the take-home amount and this option in BackTax then works backwards to show the tax, UIF, SDL as well as the gross salary amount and the cost-to-company amount instantly and 100% accurately. No other tax software has this unique and very useful feature of being able to work backwards or forwards.

How many times have you been given only the take-home amount and asked to calculate the gross salary, tax and UIF deduction etc? BackTax works it all out for you instantly. Add or change fringe benefit amounts, medical aid contribution amounts, pension etc and BackTax re-calculates everything in an instant. How long will this take you to work this out by hand using the usual trial-and-error-substitution method – an hour, two hours? What is your time worth per hour? What does BackTax cost? (BackTax is also fully tax deductible)

- BackTax is also ideal for designing salaries and for optimising salaries

- BackTax offers so much value for so little money

- BackTax will save you hours of work

Note that we release new tax software, for the new tax year, within 3 days of the budget speech every February. New versions of BackTax for the new tax year include all the new tax tables, rebates and tax legislation changes for the current tax year.

Check payslips and salary advices

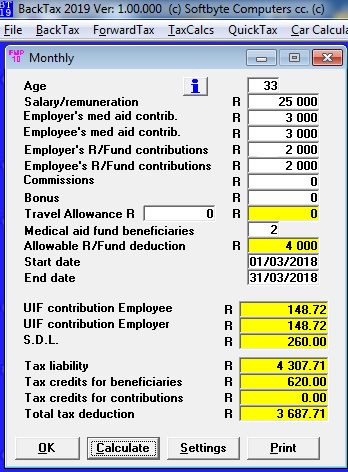

BackTax will show all the medical tax credits, UIF, SDL, tax as well as the important new limits for Retirement Fund contributions for remuneration paid monthly, daily, weekly or fortnightly and for annual IRP5’s. The all-important (and very complex) Partial periods and Bonus calculations fully catered for in all Monthly, Fortnightly, Weekly, Daily and Annual IRP5 calculations. BackTax2019 screen illustrated here.

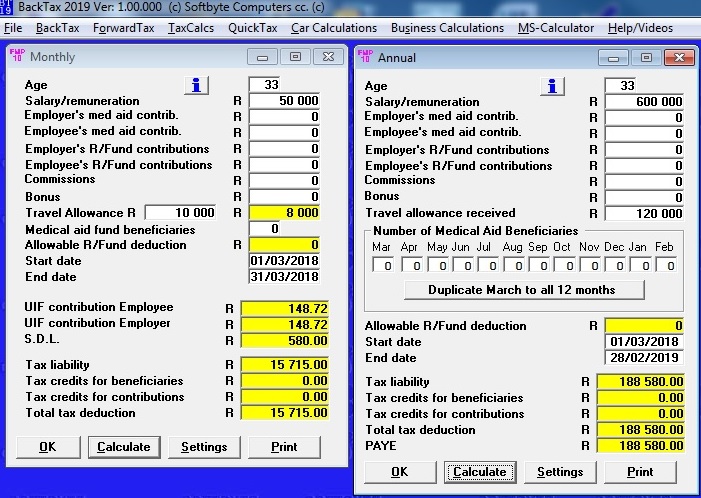

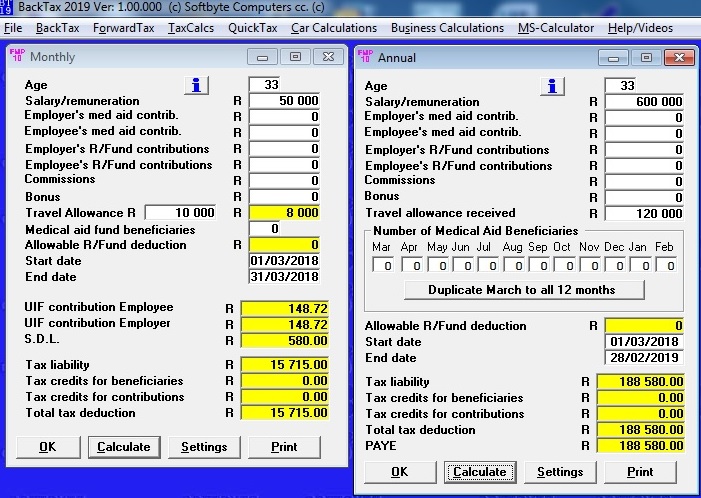

Design salaries

Easily design salaries monthly or annually, working forwards or backwards. Enter the take-home salary required and BackTax shows the gross salary the employer needs to pay so that, after R/Fund contributions, tax and UIF etc, the employee gets the exact take-home amount requested. Change any values for medical, cars, fringe benefits etc and instantly re-calculate the answers. The all-important cost-to-company amount is also displayed. (BackTax2019 screen used in this illustration).

Verify amounts on pay slips & IRP5’s

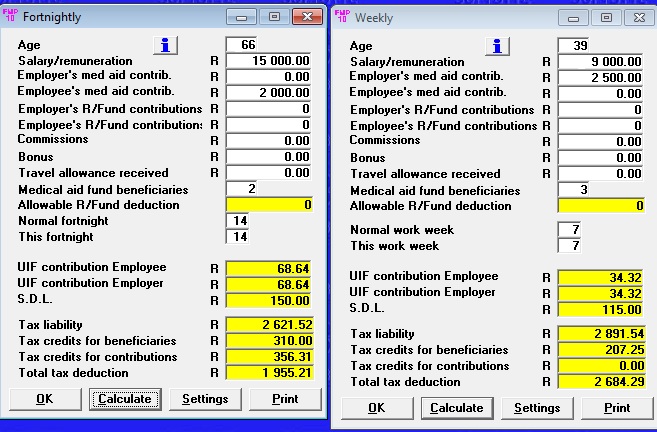

Calculate salary particulars for staff paid daily, weekly, fortnightly or monthly including the very difficult partial periods and bonus payment calculations, medical tax credits etc all done instantly for you. Play with these calculators for a few minutes and all the mysteries regarding employee’s tax at salary source will be revealed. (BackTax2019 screen used in this illustration). Backtax includes full on-screen HELP at the click of a mouse plus on-screen tax-lecture videos.

Monthly, weekly, fortnightly or daily wages

Check amounts on payslips for taxpayers paid fortnightly, monthly, weekly or even daily. (BackTax2019 screen used in this illustration). BackTax2019 shows additional tax credits for “65 and older” allowable contributions.

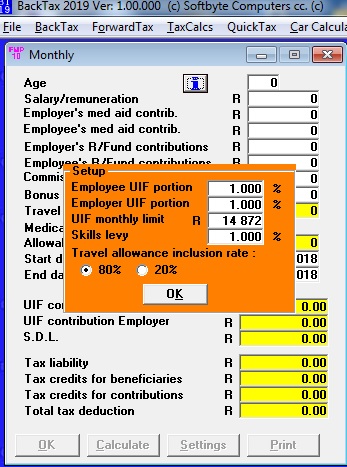

Change the program settings yourself

The Settings button option allows you to change SDL and UIF limits as well as car allowance taxable percentages etc. (Settings used here are as at March 2018 but you can change them and save them).

Check IRP5’s for tax credits etc

Check payslips or end-of-year IRP5 certificates for correct PAYE, tax credits etc. BackTax2019 screen used in this illustration showing additional tax credits for “over 65” allowable contributions.

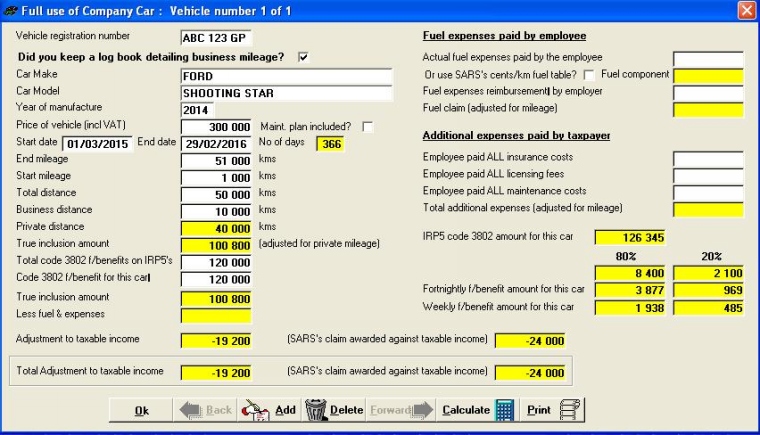

Use of Company Car fringe benefit. The truth revealed!

BackTax allows you to check fringe benefit amounts on pay slips and IRP5’s for things like having the use of a company vehicle. This calculator calculates claims against the fringe benefit for having the use of a company car (or multiple cars) during the tax year. Not only are the claims calculated and displayed but the correct fringe benefit amounts for pay slips are also displayed. Enter only the car value and the fringe benefit amounts for monthly, weekly and fortnightly pay slips are displayed. Enter the mileage figures and the end-of-year claim against taxable income is displayed as well. Both the SARS claim and the correct claim are displayed and the BackTax HELP explains how, and why, SARS’s errors occur. This feature is absolutely invaluable for audits involving a taxpayer who has the use of a company car.

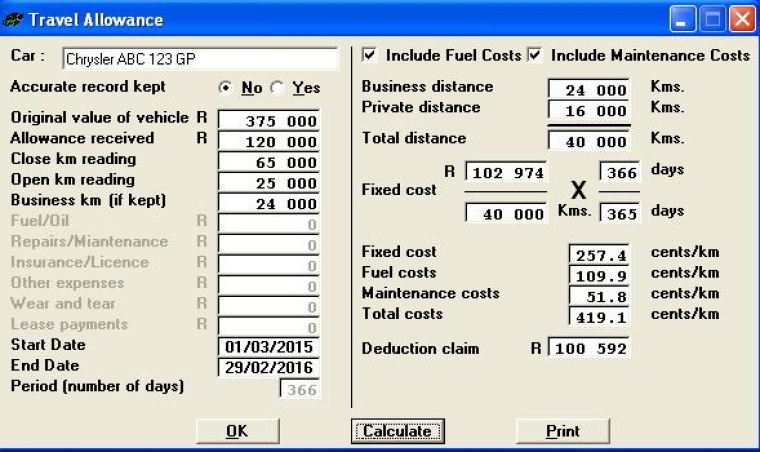

Travel Allowance Claim Calculator

Calculates and displays the claim for cases where a taxpayer receives a travel allowance, wants to claims cents/km for business distance and for cases where a taxpayer wants to claim for motoring costs. (BackTax2016 screen used in this illustration).

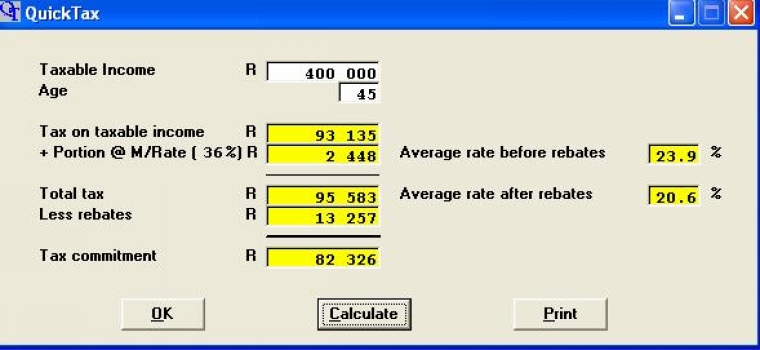

QuickTax option

The QuickTax option in BackTax2016 shows the taxpayer’s tax commitment, primary rebate, marginal and average rates of tax.

Useful Business Calculators

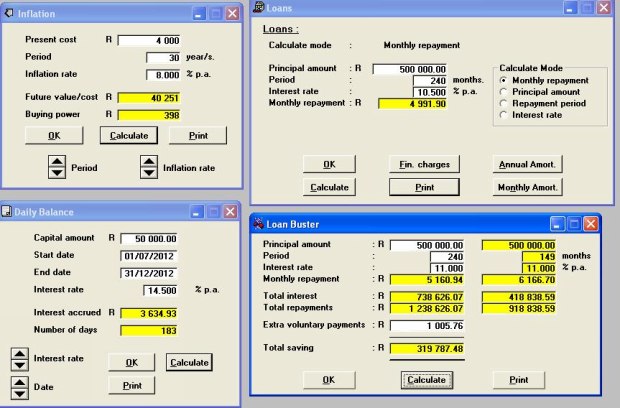

The latest versions of BackTax include business calculators such as:-

- Forward cost/value projections calculator with spin buttons to change rates and term.

- Loan repayment amount, term, interest rate or capital amount calculator.

- Loan “buster” calculator.

- Loan comparison calculator.

- Daily balance interest calculator with spin buttons to scroll rates and term.