EMV (Policies/Investments) app

This app shows the EMV (Estimated Maturity Values) of any type of pure investment from ordinary Endowments to Mutual Fund investments to Retirement/pension investments. All financial houses offering these products use the same mathematical formulas to project estimated maturity values. The only difference between them is their individual costs, admin fees and commissions etc. Investment consultants have lately found it difficult to get quotations for investment products from many financial institutions and, therefor, find it impossible to show potential investors what they could expect from their investments. What could be more convenient than having your own quotation system on your smart-phone? This app will prove to be a must-have money-maker for brokers and investment consultants.

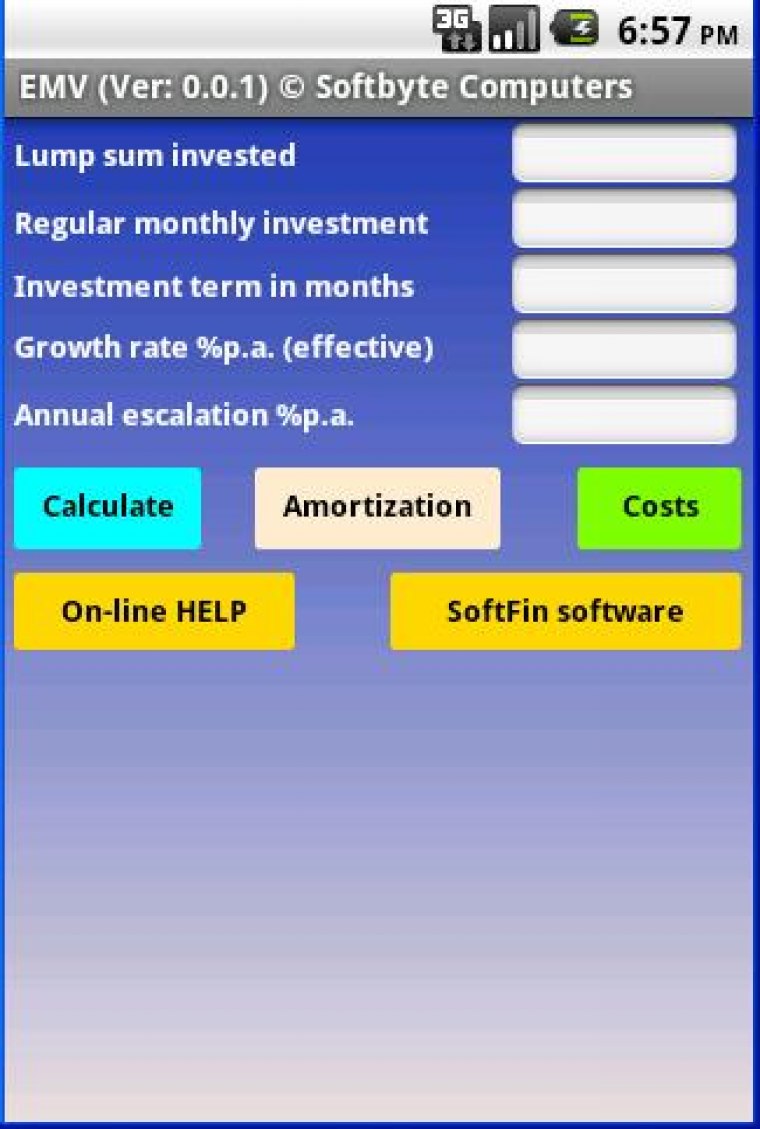

Note that, for optimum screen designs, this app only runs in “portrait” mode on phones and tablets. The app allows you to enter a single lump sum investment, a regular monthly investment or a combination of both. You enter the investment term, the effective growth rate (rate of return) expected and any annual escalation in the regular monthly investment. Investment funds always quote their effective growth rates (simply because it is a higher number than a nominal rate) but they all use nominal rates in their EMV calculations. The app will take the effective growth rate you enter and convert it to a nominal rate compounded monthly and use this nominal rate in the calculation (just as the financial institutions do in their calculations).

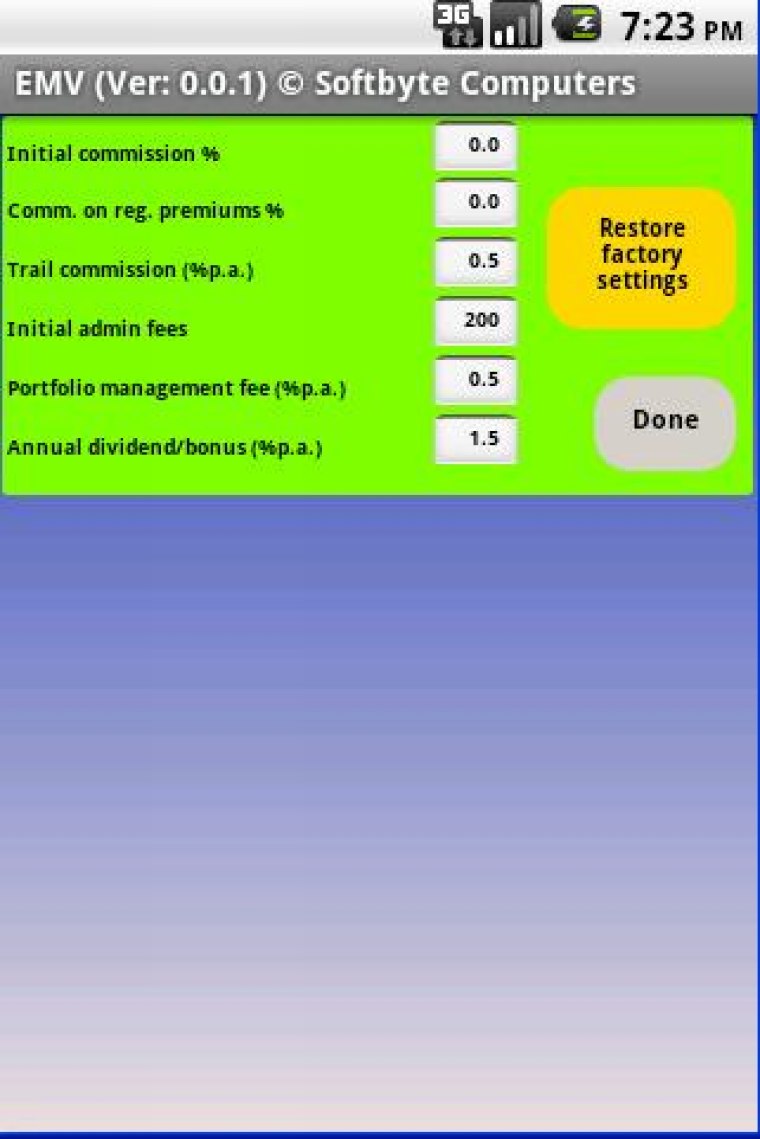

This app comes, from the software factory, with a standard set of most of these commonly-used setting values which you can change to suite any particular product offered by a particular institution or fund. This means that if you sell these types of investments for a particular financial institution then you can change these settings to make these Estimated Maturity Values even more accurate for your particular financial institution. Simply tap your finger on the “Costs” button to access this screen and change the settings. When you are finished, you only need to tap the “Done” button to save your changes which will be used in future calculations until you change them again. The trend, today, is to sell Endowment and Retirement Annuity policies largely made up by using some sort of Unit Trust or Mutual Fund portfolios as an investment medium. These funds pay dividends which are often simply re-invested into the investment. This app will show both the maturity value of the investment alone plus the maturity value of the investment with dividends re-invested.

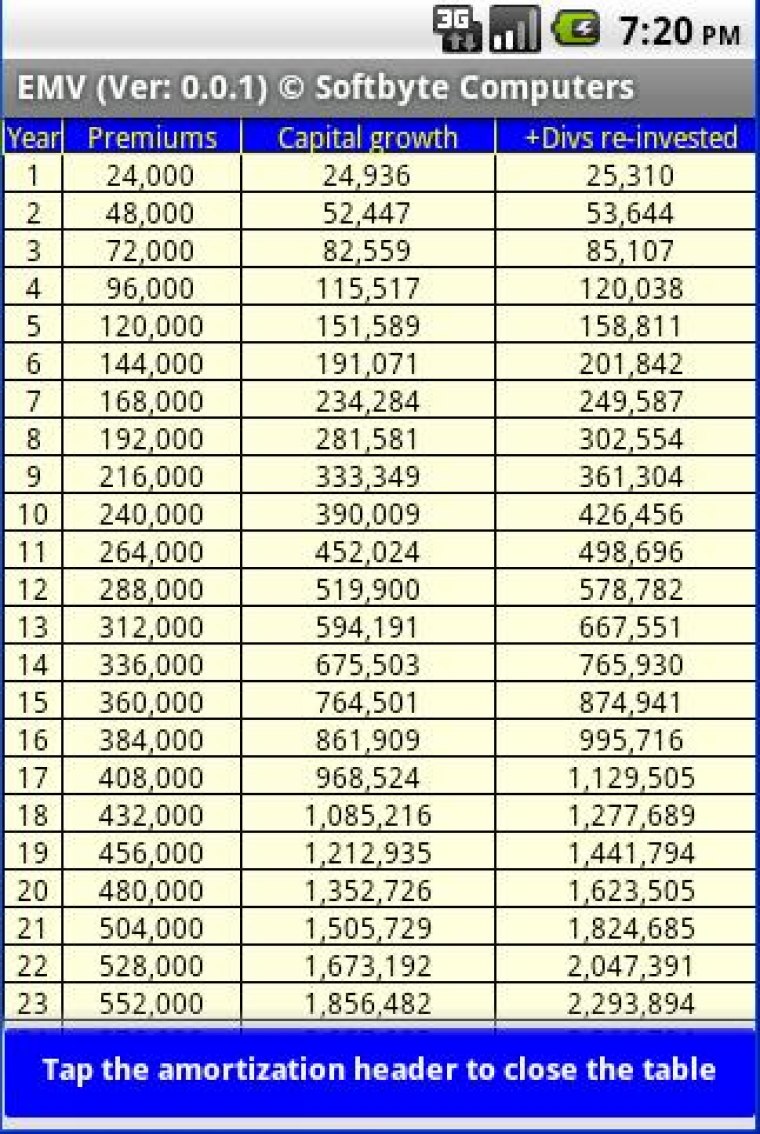

Simply tap your finger on the “Calculate” button to see a screen showing the Estimated Maturity Values. This screen not only shows the total of all investment premiums made (a very useful feature on its own when escalating premiums are concerned), but this screen also shows two maturity values; one with capital growth only and a second maturity value calculated with dividends re-invested. Let me explain. Many investment products take a part of your investment premiums to invest in shares, mutual funds etc as a part of the portfolio. Many of these share/mutual fund investments pay dividends. Some investments offer you the choice of taking these dividends when the dividends are declared or you may use the dividends to buy more shares or units. This EMV screen shows the two different maturity values you could expect from capital growth only (if you took the dividends as income during the term of the investment) or what you could expect from the investment if dividends were re-invested. Obviously the dividend rate can be set on the “Costs” screen.

Tap the “Amortization” button to see a table showing the year-by-year projected progression of the investment. Slide your finger up and down the screen on your smart-phone to scroll the table to show up to a maximum period of 50 years. The table displays columns showing, at the end of each year, the total investment/premiums paid to date, the estimated value of the investment with capital growth only and the estimated value of the investment with dividends re-invested. Tap the amortization-table header to close the scroll-able amortization table display.

More detailed info on Costs & settings

- Initial commission: Factory setting is zero but could be as high as 3% and comes off the initial amount invested. Most consultants opt for trail commission instead.

- Comm on regular premiums: Factory setting is zero but could be as high as 3%. 1/12th of the value entered here is applied to the investment premiums paid monthly. Most consultants opt for trail commission instead.

- Trail commission: Factory setting is 0.5% but could be as high as 1%. 1/12th of the percentage entered here is applied to the portfolio value every month.

- Initial admin fees: Factory setting is 200 bucks. This is a once-off cost for registering the investment and comes straight off the initial amount invested.

- Annual management fee: Factory setting is 0.5% (but could be higher) and this percentage of the portfolio value is subtracted at the end of each year. Note that some countries tax financial institutions, investment funds etc on the profits the institution or fund makes on “endowment type” investment portfolios more than they tax investment portfolios aimed at providing for retirement. The eventual difference this makes to the final maturity value of the investment varies between countries (and their tax rates) but the difference is small. Don’t forget that that these institutions have expenses and tax deductions as well so the actual effective rate which is applied to the profit the institution makes on endowment type portfolios is very low and the effect on the EMV is even lower. The app is flexible enough to cater for this and, when doing a calculation for an endowment type investment, you can increase the annual management fee by about 1% if this tax structure applies in your country.

- Annual dividend/bonus: Factory setting is 1.5% and this percentage of the portfolio value is added at the end of each year.

The app may change unreasonable figures you enter to more reasonable figures. For example, if you enter 100 million invested at 99% growth rate for 50 years then the app will reduce the growth rate to a more reasonable figure in order to be able to fit the answer on the smart-phone screen.

NOTE: Please be aware that the Estimated Maturity Values displayed by this app are calculated using internationally standard, mathematically correct methods of calculating estimated maturity values. Obviously any accurate answer relies on costs as well as growth rates remaining constant for the entire term which, as we all know, is unlikely to happen. However, consultants and investors want to know, if all factors remain the same, what an estimate of the maturity value will be and this app will show them that. It is a well nigh impossible task to convince anyone to invest money, for his retirement for example, if you cannot give them an estimate of the amount they could expect to receive at the end of the investment term. This app will do that for you and is a “must have” tool on any investment consultant’s smart-phone.

Note that you may be required to change the Security setting on your phone/tablet to allow you to temporarily install “non-market apps”. After installing the EMV app from our web site we recommend that you change this setting on your phone/tablet back to not allow the installing of “non-market” apps.