Share Income app

It has long been known that, to beat inflation and the tax-man, the investor should look to the stock markets. Investment funds all over the world have put together “baskets” containing collections of high-growth share. These investment funds employ highly skilled, and very highly paid, people who study the markets constantly and they switch money from one fund to another, and back again, as the market dictates. The thing they look for is high-growth shares; shares with prices which are on the rise compared to shares with steady prices that produce dividend earnings. The moment a “high growth” share’s price looks like it could falter then that money is switched to shares that are performing better. When markets decline, that money may even be temporarily switched to more stable equity markets. Even in bad economic times, the better performing share-investment portfolios have still managed to show growth, to beat bank investment rates and beat inflation. This is due to the fact that, firstly, well managed share portfolios have proved to offer far better rates of return than bank interest rates and, secondly, the tax implications on income from shares are usually far kinder to investors than tax implications on interest received from bank investments.

When you invest an amount of money with such an investment fund they use your money to buy shares in a spread of share-funds that they call a “basket” of funds. When you draw income, the income you receive comes from your shares which the investment fund sell on your behalf. You are not liable for tax on the income you receive, you are only liable for tax on the profits you make from the disposal of the shares in much the same way as you are taxed on the profit you make on any other assets you dispose of that are liable for gains tax. This Capital Gains Tax does not affect the investment portfolio returns at all and it is up to the investor to settle this tax bill with Revenue at assessment time. A quick note on this; you only pay CGT on the profit you make on the shares you sell to get income. This profit is the difference between the price of the shares when you bought them and the price of the shares when you sold them. This profit is usually subject to sort sort of exclusion/s and only a portion of the profit is added to normal income for tax. Unless huge amounts of money are involved here, CGT can often be very little.

If the company/institution in which you have shares issues dividends then these dividends are now taxable in the hands of the company/institution. This is part of a global network of tax-compliance arrangements between countries. Tax is deducted by the companies/institutions and paid over to Revenue when the dividends are issued. The rate of tax is usually 15%. This means that you will receive less of any dividend issued. If a dividend of 10% is issued at the end of a year then, instead of adding 10% to your portfolio value, only 8.5% will be added. This app caters for all that.

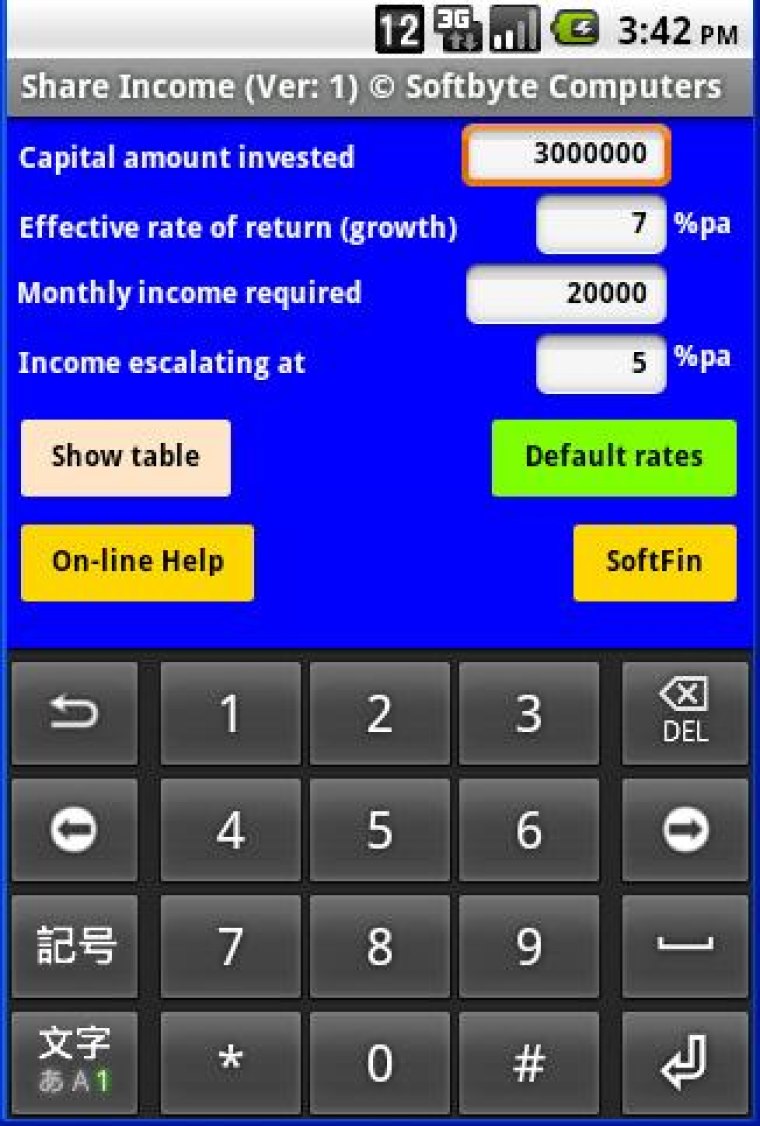

The app’s capture screen shows 5 million invested at a growth rate of 7% and drawing an initial 20,000 a month increasing at 5% a year. We have entered an effective tax rate of 1% to be applied to the profit portion of our income drawn. The app will take the rate of return you enter and convert it a nominal rate to use to compound interest/growth monthly.

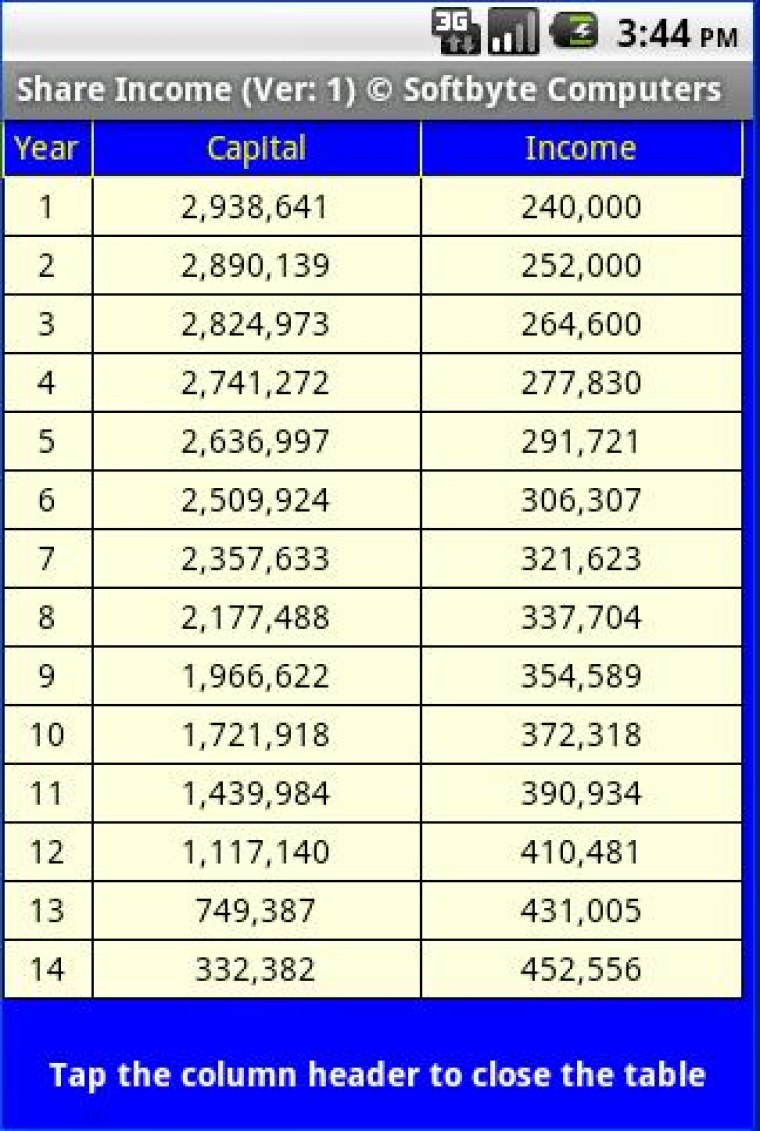

When we tap the “Display table” button we see the progress of our investment, year by year, for the life of the investment (while any capital still remains to provide income). We can immediately see how long our invested capital will continue to provide the income we require. The table runs up to a maximum of 50 years or until the capital runs out. Obviously closing this table screen and going back to change income amounts or income escalation rates (or anything we like) could then provide a whole new set of figures in the table. For the first time on your smart-phone, you are now able to show the investor exactly how his investment will progress; including being able to show them the real danger of taking too much income. The app is so flexible that it even allows you to enter a negative income escalation rate to show the effect of taking an income which decreases each year.

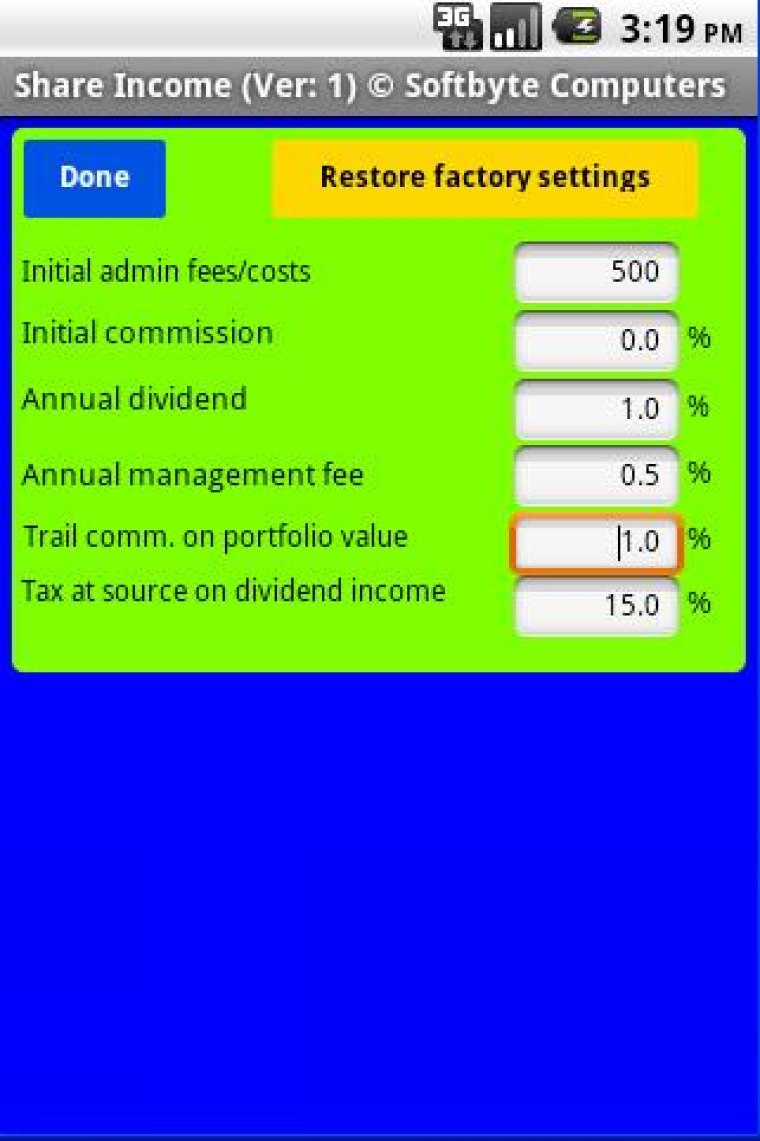

The Share Income app comes with a set of Default values for either upfront commissions and costs or regular on-going trail commission calculated on a percentage of the portfolio, admin fees, bonus dividend etc. Changing these figures will change the results of our calculations. If you work for a particular investment fund then you can set your particular company’s costs to be used in all illustrations if you wish.

More detailed info on Costs & settings

- Initial admin fees/costs: There is normally a cost of a few hundred bucks to put an investment portfolio “on the books”.

- Initial commission: Factory setting is zero but could be as high as 3% and comes off the initial amount invested. Most consultants opt for trail commission instead.

- Annual dividend/bonus: Factory setting is 1% and this percentage is reduced by the percentage of tax on dividends and added to the portfolio value at the end of each year. If the tax percentage on dividends is 15% then the 1% dividend will be reduced to 0.85% in the calculations. If you set this value to the 20% currently levied on dividends in SA then the 1% dividend it will be reduced to 0.80% in the calculation.

- Annual management fee: Factory setting is 1% (but could be higher) and this percentage of the portfolio value is subtracted at the end of each year.

- Trail commission: Factory setting is 1%. 1/12th of the percentage entered here is applied to the portfolio value every month.

If the Investment Fund states that their growth figures are net figures (after all costs and commissions) then you can set all these costs & commissions in the app to zero.

The app may change unreasonable figures you enter to more reasonable figures. For example, if you enter 100 million invested at 99% growth rate for 50 years then the app will reduce the growth rate to a more reasonable figure in order to be able to fit the answer on the smart-phone screen.

NOTE: Please be aware that the values displayed by this Share Income app are calculated using internationally standard, mathematically correct methods of calculating these values. Obviously any accurate answer relies on costs as well as growth rates remaining constant for the entire term which, as we all know, is unlikely to happen. However, consultants and investors want to know, if all factors remain the same, what the values, how long the capital will last etc and this app will show them that. It is a well nigh impossible task to convince anyone to invest money, for his retirement for example, if you cannot give them an estimate of the amount they could expect to receive and how long they could expect to receive that income. This app will do that for you and is a “must have” tool on any investment consultant’s smart-phone. The app can be set up to work for virtually any type of “draw-down” scenario investment.

Note that you may be required to change the Security setting on your phone/tablet to allow you to temporarily install “non-market apps”. After installing the Share Income app from our web site we recommend that you change this setting on your phone/tablet back to not allow the installing of “non-market” apps.